by Calculated Risk on 9/10/2011 08:15:00 AM

Saturday, September 10, 2011

Summary for Week ending Sept 9th

This was a light week for economic data and the focus was mostly on the financial crisis in Europe, and also on speeches by President Obama (a new stimulus proposal) and by Fed Chairman Ben Bernanke (the Fed appears prepared to act after the two day meeting ending on Sept 21st).

There was some good news: the trade deficit declined sharply in July (and the trade deficit was revised down for earlier months). This led Goldman Sachs to upgrade their Q3 GDP forecast yesterday: "We revised up our Q3 GDP growth forecast from 1% to 2% (annual rate) on the back of better-than-expected trade and consumer spending data." The ISM non-manufacturing index was weak, but still indicated expansion in the service sector - and that was better than expected.

Next week will be busier for U.S. economic data, including a few surveys for September that will probably show improvement since August. Of course Europe - and Greece - will remain a major focus.

Here is a summary in graphs:

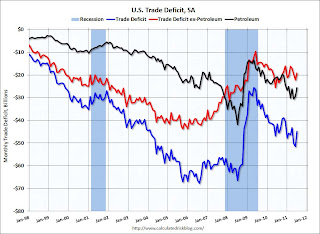

• Trade Deficit decreased sharply in July

Click on graph for larger image.

Click on graph for larger image.

The Department of Commerce reported "[T]otal July exports of $178.0 billion and imports of $222.8 billion resulted in a goods and services deficit of $44.8 billion, down from $51.6 billion in June, revised. July exports were $6.2 billion more than June exports of $171.8 billion. July imports were $0.5 billion less than June imports of $223.4 billion."

Exports increased and imports decreased in July (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to July 2010; imports are up about 13% compared to July 2010.

The trade deficit was well below the consensus forecast of $51 billion.

The second graph shows the U.S. trade deficit, with and without petroleum, through July. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The second graph shows the U.S. trade deficit, with and without petroleum, through July. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The decline in the trade deficit was due to an increase in exports. Also the trade deficit for the first six months of the year was revised down - especially in Q2.

• ISM Non-Manufacturing Index indicates expansion in August

The August ISM Non-manufacturing index was at 53.5%, up from 52.7% in July. The employment index decreased in August to 51.6%, down from 52.5% in July. Note: Above 50 indicates expansion, below 50 contraction.

The August ISM Non-manufacturing index was at 53.5%, up from 52.7% in July. The employment index decreased in August to 51.6%, down from 52.5% in July. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 50.5% and indicates slightly faster expansion in August than in July.

• BLS: Job Openings "little changed" in July

From the BLS: Job Openings and Labor Turnover Summary "The number of job openings in July was 3.2 million, little changed from June. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in July was 1.1 million openings higher than in July 2009 (the most recent trough)."

From the BLS: Job Openings and Labor Turnover Summary "The number of job openings in July was 3.2 million, little changed from June. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in July was 1.1 million openings higher than in July 2009 (the most recent trough)."

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in July - and are up about 13% year-over-year compared to July 2010.

Overall turnover is increasing too, but remains low. Quits increased slightly in July, and have been trending up - and quits are now up about 9% year-over-year.

• Weekly Initial Unemployment Claims increase to 414,000

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 414,750.

Weekly claims increased slightly, and the 4-week average is still elevated - and remains above the 400,000 level.

• Mortgage Rates fall to Record Low

From Freddie Mac: Mortgage Rates Attain New All-Time Record Lows Again "Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, hitting all-time record lows ..."

From Freddie Mac: Mortgage Rates Attain New All-Time Record Lows Again "Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, hitting all-time record lows ..."

Here is a long term graph of 30 year mortgage rate in the Freddie Mac survey. The Freddie Mac survey started in 1971. Mortgage rates are currently at a record low for the last 40 years (mortgage rates were close to this range in the '50s).

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®. Refinance activity declined a little last week, but activity was up significantly in August compared to July.

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®. Refinance activity declined a little last week, but activity was up significantly in August compared to July.

With 30 year mortgage rates now at record lows, mortgage refinance activity will probably pick up some more in September - but so far activity is lower than in '09 - and much lower than in 2003.

• Other Economic Stories ...

• Fed's Beige Book: "Economic activity continued to expand at a modest pace"

• From Chicago Fed President Charles Evans: The Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy

• CBO: An Evaluation of Large-Scale Mortgage Refinancing Programs

• From Jon Hilsenrath at the WSJ: Fed Prepares to Act

• From Fed Chairman Ben Bernanke: The U.S. Economic Outlook

• The American Jobs Act

• AAR: Rail Traffic mixed in August

• Lawler: Early Read on Existing Home Sales in August