by Calculated Risk on 10/28/2011 01:21:00 PM

Friday, October 28, 2011

Q3 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

The BEA released the underlying detail data today for the Q3 Advance GDP report. As expected, the recent pickup in non-residential structure investment has been for power and communication. Here is a look at office, mall and lodging investment:

Click on graph for larger image.

Click on graph for larger image.

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and then declined sharply. Investment has increased a little recently (probably mostly tenant improvements as opposed to new office buildings).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). Mall investment declined in Q3.

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by over 80%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). This is happening again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

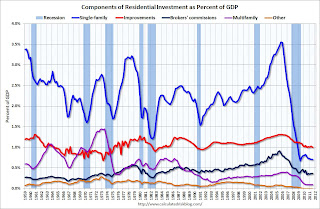

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $151 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (about 1.0% of GDP), significantly above the level of investment in single family structures of $106 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions increased slightly in Q3, and are moving sideways as a percent of GDP.

And investment in multifamily structures is still moving sideways as a percent of GDP (increasing slowly in dollars). This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging - and for residential investment.