by Calculated Risk on 10/15/2011 08:15:00 AM

Saturday, October 15, 2011

Summary for Week Ending Oct 14th

The European financial crisis is nearing a critical point. The enhanced EFSF has been approved, and it appears Greece will receive the next loan installment in early November. Now the discussion is focused on recapitalizing European banks and on how to leverage the EFSF (probably some sort of insurance plan). A couple of articles this morning:

From the WSJ: Germany, France Close In on Crisis Plan

The plan taking shape is built on three central elements: the new bailout for Greece, an effort to shore up the banks affected by Greek losses (and fearful of Italian and Spanish losses) and additional firepower for the bailout fund to provide a reassuring backstop.And from the Financial Times: Investor threat to second Greek bail-out

The lead negotiator for private holders of Greek debt has said that investors are unwilling to accept greater losses on their bonds than the 21 per cent agreed in July, jeopardising eurozone plans to finalise a second Greek bail-out by the end of next week.The next key date is Sunday October 23rd when European Union leaders will hold a summit meeting. Germany and France have promised a comprehensive plan by November 4th.

excerpt with permission

Also there is a summit of G20 finance ministers in Paris today, and the ministers are expected to show support for European leaders.

There was little U.S. economic data released last week. Retail sales were strong in September, and the trade deficit was unchanged in August from July. Both better than expected. Consumer sentiment was still very low, as was small business confidence.

Next week will be a little busier!

Here is a summary in graphs:

• Retail Sales increased 1.1% in September

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a monthly basis, retail sales were up 1.1% from August to September (seasonally adjusted, after revisions), and sales were up 7.9% from September 2010. Retail sales excluding autos increased 0.6% in September. Sales for August were revised up to a 0.3% increase.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 18.9% from the bottom, and now 4.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 6.4% on a YoY basis (7.9% for all retail sales). The consensus was for retail sales to increase 0.8% in September, and for a 0.4% increase ex-auto. This was a strong report, especially with the upward revisions to both July and August.

• Trade Deficit unchanged at $45.6 billion in August

"[T]otal August exports of $177.6 billion and imports of $223.2 billion resulted in a goods and services deficit of $45.6 billion, virtually unchanged from July, revised." This was slightly below the consensus forecast of $46 billion.

"[T]otal August exports of $177.6 billion and imports of $223.2 billion resulted in a goods and services deficit of $45.6 billion, virtually unchanged from July, revised." This was slightly below the consensus forecast of $46 billion.This graph shows the monthly U.S. exports and imports in dollars through August 2011. Exports and imports were mostly unchanged in August (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to August 2010; imports have stalled recently and are up about 11% compared to August 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The second graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $102.62 per barrel in August, down slightly from $104.27 per barrel in July. The trade deficit with China increased to a record $29 billion; trade with China remains a significant issue.

Imports have been moving sideways for the last several months - partially due to slightly lower oil prices. However the trade deficit with China continues to increase. Exports are still generally trending up.

• NFIB: Small Business Optimism Index increases slightly in September

From the National Federation of Independent Business (NFIB): Small-Business Confidence Sees Modest Gain: The Start of a Trend, or a Blip?

From the National Federation of Independent Business (NFIB): Small-Business Confidence Sees Modest Gain: The Start of a Trend, or a Blip? This graph shows the small business optimism index since 1986. The index increased to 88.9 in September from 88.1 in August.

Optimism had declined for six consecutive months and this is just a small increase. Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

This graph shows the net hiring plans for the next three months.

This graph shows the net hiring plans for the next three months.Hiring plans were still low in September, but still positive and the trend is up.

According to NFIB: “Over the next three months, 11 percent plan to increase employment (unchanged), and 12 percent plan to reduce their workforce (unchanged), yielding a seasonally adjusted 4 percent of owners planning to create new jobs, also down 1 point from August."

This index has been slow to recover - probably due to a combination of the recent economic weakness, and also the high concentration of real estate related companies in the index.

• BLS: Job Openings "little changed" in August

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Notice that hires (dark blue) and total separations (red and blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (dark blue) and total separations (red and blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.In general job openings (yellow) has been trending up, and are up about 7% year-over-year compared to August 2010. Layoffs and discharges are down about 10% year-over-year.

Quits increased in August, and have been trending up - and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Weekly Initial Unemployment Claims at 404,000

This graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 408,000.

This is the lowest level for the 4-week average of weekly claims since August. This is still elevated, but the decline in the 4-week average is a positive.

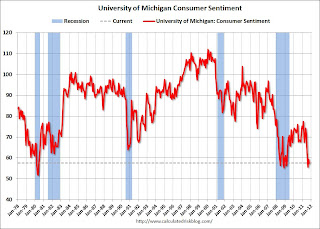

• Consumer Sentiment declines in October

The preliminary October Reuters / University of Michigan consumer sentiment index declined to 57.5 from 59.4 in September.

The preliminary October Reuters / University of Michigan consumer sentiment index declined to 57.5 from 59.4 in September.In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate. History suggests it usually takes 2 to 4 months to bounce back from an event (If we can call the threat of default an "event"). So sentiment might increase over the next couple of months.

And, of course, any bounce back from the debt ceiling debate would be to an already weak reading. This was a very weak reading.

• Other Economic Stories ...

• From the NY Times: Recession Officially Over, U.S. Incomes Kept Falling

• From Reuters: EU leaders delay summit to agree crisis plan

• EC, IMF, ECB says aid likely for Greece

• Ceridian-UCLA: Diesel Fuel index declined in September

• FOMC Minutes: "Considerable uncertainty surrounding the outlook for a gradual pickup in economic growth"