by Calculated Risk on 10/01/2011 08:15:00 AM

Saturday, October 01, 2011

Summary for Week Ending Sept 30th

Once again the European financial crisis dominated the headlines last week. The new property tax proposal was approved in Greece, and the EU-IMF-ECB inspectors have returned.

There is meeting of EU Finance Ministers on Monday, October 3rd, but the vote on the next €8bn payment will be at an emergency meeting in two weeks after the inspectors complete their review. Greece is expected to run out of money mid-October, so this is going down to the wire. No payment means default in October.

Even if it is approved, the next installment is expected to last only until December, so this just buys a little time.

Also, on Thursday, the German Parliament voted to increase the European Financial Stability Facility (EFSF) per the agreement reached on July 21st. The voting of the various countries is almost complete.

As usual the story keeps changing out of Europe. Will there be a leveraged EFSF? Will there be forced bank recapitalization like with TARP in the U.S.? Will the EFSF be expanded or enhanced in some other way? Will the haircuts on Greek debt be increased (some say 50%)?

Europe appears to have the resources to resolve the crisis, but they lack the mechanisms and the political unity. The clock is ticking.

In the U.S., the September data was mostly better than in August. The Chicago Purchasing Manager’s Index surprised to the upside with positive comments about employment.

And look at these headlines for the September regional manufacturing surveys:

• From the Kansas City Fed: Growth in Manufacturing Activity Edged Higher

• From the Dallas Fed: Texas Manufacturing Activity Picks Up

• From the Richmond Fed: Manufacturing Activity Contracted at a Slightly Slower Pace in September, While Employment Grew and Expectations Improved

This is a key theme: August was very weak, but September was a little better.

For the August data, New Home sales declined slightly and continue to move sideways, real personal consumption expenditures (PCE) declined slightly, the trucking index declined, and the restaurant index declined too. Clearly the economic data in August was very weak and negatively impacted by the debt ceiling debate.

And because of the weak data, the talk of another U.S. recession continues to grow, with several people arguing the U.S. is already in recession. I think that is unlikely, but sluggish growth will seem like a recession to many people. And there are significant downside risks from the European crisis.

There will be more key data for September next week including auto sales and the employment report next Friday.

Here is a summary in graphs:

• New Home Sales declined slightly in August

The Census Bureau reported New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 295 thousand. This was down from a revised 302 thousand in July (revised up from 298 thousand).

The Census Bureau reported New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 295 thousand. This was down from a revised 302 thousand in July (revised up from 298 thousand).

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 60,000 units in August. The combined total of completed and under construction is at the lowest level since this series started. Months-of-supply was at 6.6 months; less than 6 months is normal.

The next graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In August 2011 (red column), 26 thousand new homes were sold (NSA). The record low for August was 23 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for August was 110 thousand in 2005.

In August 2011 (red column), 26 thousand new homes were sold (NSA). The record low for August was 23 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for August was 110 thousand in 2005.

This was at the consensus forecast of 295 thousand, and was not far above the record low for the month of August set last year. New home sales have averaged only 300 thousand SAAR over the 16 months since the expiration of the tax credit ... still moving sideways at a very low level.

• Case Shiller: Home Prices increased Seasonally in July

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

The Composite 10 index is off 32% from the peak, and was down slightly in July (SA). The Composite 10 is 1.4% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and was up slightly in July (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

On a Not Seasonally Adjusted (NSA) basis, both indexes were up 0.9% in July over June.

This graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 9 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.

This graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 9 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.

As S&P noted, prices increased in 17 of 20 cities not seasonally adjusted (NSA).

Most of this prices increase was mostly seasonal. As S&P's David Blitzer said: "This is still a seasonal period of stronger demand for houses, so monthly price increases are expected ... ". The question is what happens later this year.

• Real House Prices and House Price-to-Rent

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Nominal House Prices

This shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through July) and CoreLogic House Price Indexes (through July) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to July 2003.

Real House Prices

Real House Prices

This graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to August 2000, and the CoreLogic index back to July 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

Price-to-Rent

Here is a price-to-rent graph using the Case-Shiller Composite 20 and CoreLogic House Price Index and Owners' Equivalent Rent from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to July 2000.

• Personal Income decreased 0.1% in August, Spending increased 0.2%

The BEA released the Personal Income and Outlays report for August: "Personal income decreased $7.3 billion, or 0.1 percent ... in August ... Personal consumption expenditures (PCE) increased $22.7 billion, or 0.2 percent.

The BEA released the Personal Income and Outlays report for August: "Personal income decreased $7.3 billion, or 0.1 percent ... in August ... Personal consumption expenditures (PCE) increased $22.7 billion, or 0.2 percent.

...

Real PCE -- PCE adjusted to remove price changes -- decreased less than 0.1 percent in August, in contrast to an increase of 0.4 percent in July. ... The price index for PCE increased 0.2 percent in August,compared with an increase of 0.4 percent in July. The PCE price index, excluding food and energy, increased 0.1 percent"

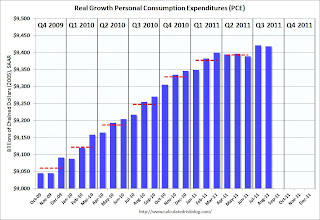

This graph shows real Personal Consumption Expenditures (PCE) through August (2005 dollars).

PCE increased 0.2 in August, and real PCE decreased slightly as the price index for PCE increased 0.2 percent in August.

Using the two month method to estimate Q3 PCE gives a 1.1% annualized rate (another weak quarter), however it appears PCE increased in September (auto sales are up) and June was especially weak in Q2 - so real PCE growth will probably be in the 1.5% range in Q3 (still weak).

• September Consumer Sentiment increases to 59.4

The final September Reuters / University of Michigan consumer sentiment index increased to 59.4 from 55.7 in August.

The final September Reuters / University of Michigan consumer sentiment index increased to 59.4 from 55.7 in August.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

Note: It usually takes 2 to 4 months to bounce back from an event driven decline in sentiment (if the August decline was event driven) - and any bounce back from the debt ceiling debate would be to an already weak reading.

This was still very weak, but above the consensus forecast of 57.8.

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

So the key number in this report is that as of July, there were 1.6 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

• Regional Manufacturing Surveys show less weakness

Three more regional manufacturing surveys were released last week.

From the Kansas City Fed: Growth in Manufacturing Activity Edged Higher

From the Dallas Fed: Texas Manufacturing Activity Picks Up

From the Richmond Fed: Manufacturing Activity Contracted at a Slightly Slower Pace in September, While Employment Grew and Expectations Improved

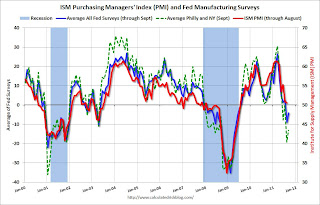

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index.

The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 3rd and this suggests another weak reading in September.

• Weekly Initial Unemployment Claims decline sharply to 391,000

The DOL reported: "In the week ending September 24, the advance figure for seasonally adjusted initial claims was 391,000, a decrease of 37,000 from the previous week's revised figure of 428,000."

This graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 417,000.

This is the lowest level for weekly claims since early April, although the 4-week average is still elevated.

• Other Economic Stories ...

• The Chicago PMI Chicago Business Barometer™ Rebounded: The overall index increased to 60.4 from 56.5 in August.

• From the NAR: Pending Home Sales Decline in August

• The BEA reported that GDP increased at a 1.3% real annual rate in Q2 (third estimate), revised up from the previously reported 1.0% increase.

• Restaurant Performance Index declined in August

• Fannie Mae and Freddie Mac Serious Delinquency Rates decline in August

• Hotels: Occupancy Rate increased 4.1 percent compared to same week in 2010

• ATA Trucking Index decreased slightly in August

• Existing Home Inventory continues to decline year-over-year in September

• The BLS released the preliminary annual benchmark revision of +192,000 payroll jobs as of March 2011.