by Calculated Risk on 12/21/2011 06:13:00 PM

Wednesday, December 21, 2011

Lawler: The NAR “benchmark revision story” is not over!

NOTE: Large tables are here in excel.

From housing economist Tom Lawler on the NAR revisions:

Seasonally Adjusted Existing Home Sales Up 4% in November; Benchmark Revisions Reduce 2007-10 Sales by 14.3%; Regional Revisions Seem “Funny,” Suggest Issues with Past Data as Well

The National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 4.42 million in November, a figure that reflected that NAR’s long-awaited “benchmark” downward revisions in sales for 2007 through 2010. November’s revised sales pace was up 4% on a SA basis from October’s pace, and was pretty close to my estimate incorporating revisions. The NAR also reported that its estimate of the inventory of existing homes for sale at the end of November was 2.580 million, an estimate that also reflected benchmark revisions (the NAR had previously noted that it was not revising its “months’ supply” measure, and as a result inventories would be revised down by the same % as sales). The November inventory estimate was down 5.8% from October (vs. my projection of a 5% drop); down 18.1% from a year ago; and the lowest inventory level since the spring of 2005.

November’s median existing home sales price in November was $164,200, down 3.5% from last November, while the median existing home sales price was $164,100, down 4.0% from a year ago. This YOY decline was just a tad smaller than I had projected. As previously reported, the NAR did not revise historical median sales prices (save for October 2011).

As I had expected, the NAR used data from the American Community Survey (and from the American Housing Survey) to “guesstimate” home sales, rather than using actual property records – in large part because the latter are either not available in many parts of the country, or the data quality are poor. The NAR did note, however, that “an increasing use of public records data may be appropriate in the future,” which is absolutely the case.

The NAR released revisions to annual sales, monthly seasonally adjusted sales, and monthly unadjusted sales. However, the annual revised sales reported don’t match the sum of unadjusted monthly sales, and because of rounding the sum of SF sales and condo sales does not match total sales in every year. As a result, I am going to report the “revised” sales as the sum of unadjusted sales estimates.

For the nation as a whole, existing home sales were as follows:

| Revised | Previous | % Change | |

|---|---|---|---|

| 2007 | 5,022,000 | 5,652,000 | -11.1% |

| 2008 | 4,124,000 | 4,913,000 | -16.1% |

| 2009 | 4,334,000 | 5,156,000 | -15.9% |

| 2010 | 4,182,000 | 4,907,000 | -14.8% |

At first glance these “national” numbers don’t appear that far off from other estimates based on property records, “grossing up” the totals to reflect geographic coverage.

However, the revisions in existing home sales by broad region suggest that something “looks funny,” and/or that data prior to 2006 in some regions need to be revised as well.

See Table 2 in Excel file

Huh? Sales in the Northeast were revised down by a TON more than any other region, while sales in the West were revised down by a TON less! That seems “sorta weird,” IF the reasons for the revisions were as the NAR suggested. The modest revisions in the West were especially surprising, given that property records data in California – which are comprehensive and of good quality – suggested that the NAR’s estimate of California existing home sales in, say, 2008 was off by more than 20%!

To be sure, there was evidence of NAR sales “over-estimates” in one major Northeast state – Massachusetts – with the “overstatements” date back to at least 2000. Here, e.g., is an excerpt from the September 23, 2009 LEHC report.

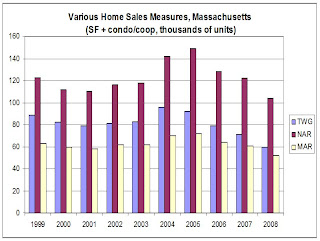

Three Measures of Home Sales in Massachusetts

Below is a chart showing annual data on various measures of home sales in Massachusetts. NAR is the National Association of Realtors estimate of existing home sales (single family plus condos/coops); MAR is the Massachusetts Association of Realtors tally of homes (single family plus condo/coop) sold by member realtors; and TWG is The Warren Group’s tally of new and existing homes sold (single family and condo/coop) based on deeds recorded in the state. TWG only includes “arms-length” transactions, and does NOT include a transaction where a lender takes over a foreclosed property – but it DOES include subsequent sales of REO to third parties.

Click on graph for larger image.

Click on graph for larger image.Inquiring minds want to know (1) why is the NAR number so high? (and the answer may data back to the “benchmarking” process for 1999); (2) is it REALLY true (based on the NAR figures) that realtors only partake in 50% of Massachusetts home sales?; and (3) if sales through MLS have risen relative to total sales (as data in a number of states suggest over the last few years), have the NAR’s estimates of existing home sales been overstating actual sales? (The NAR’s estimate for total existing home sales is based on sales data from a sample of realtor associations/Boards/MLS.).

And on how to answer the home sales question on Mass ... let us pray.

So ... property records data had for over a decade suggested that the NAR’s estimate of existing home sales in Massachusetts, and that the NAR’s PREVIOUS benchmarking methodology, especially for condo sales, might be to blame. So maybe the sharp downward revision in Northeast sales is sorta appropriate – but the data also suggest needed downward revisions in past years as well.

And speaking of condos vs. SF, [in Table 3] are the benchmark revisions for existing SF and existing condo sales, both total and by region.

See Table 3 in excel file.

Holy smoke, condo sales in the Northeast were revised down by over 50% --- FIFTY PERCENT – in each of the last four years, while condo sales in the West were revised UP a boatload!

Now if the 2007 revisions were really reasonable by region, AND if data prior to 2006 by region were “just fine,” here is what 2006 vs. 2007 sales would look like by region.

See table 4.

So … the plunge in home sales in 2007 was not only heavily concentrated in the Northeast, but condo sales in the Northeast in 2007 fell by almost 58% from 2006, while condo sales in the West JUMPED by about 33%? I don’t THINK so!

Clearly, the methodology using ACS data for owner-occupied SF sales and combined ACS and AHS data for condo sales and investor/vacant home sales, produced massively different revisions by regions and by housing type that don’t “smell” right – especially for condo sales.

Of course, this doesn’t mean they are “off” per se; the old benchmarking methodology seemed especially “iffy” for SF and condo/co-op investor/vacant home sales, as does the current methodology.

So ... while the NATIONAL existing home sales estimates prior to 2007 don’t seem far off from national estimates based on grossed-up property records, the regional data seems to suggest that a time series using the “old” data prior to 2006 and the “revised” data from 2007 to 2011 has some “issues.”

What would be most useful would be for the NAR to release its revised existing home sales estimates BY STATE, so that folks could compare the NAR’s estimate for states where solid property records data exist TO the property records data for those states, as well as compare the “old” 2006 data to the “revised” 2007 data.

Clearly, the “benchmark revision story” is not over!

Earlier:

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

• Existing Home Sales Revisions

• CoreLogic: Existing Home Shadow Inventory remains at 1.6 million units

• Existing Home Sales graphs