by Calculated Risk on 12/30/2011 02:56:00 PM

Friday, December 30, 2011

Question #9 for 2012: Inflation

Last weekend I posted some questions for next year: Ten Economic Questions for 2012. I'll try to add some thoughts, and maybe some predictions for each question over the next week.

Many of the questions are interrelated. The question on monetary policy depends on inflation (question #9), the unemployment rate (question #6) and what happens in Europe (question #8). And the unemployment rate is related to GDP growth (question #4), and on and on ...

9) Inflation: Will the inflation rate rise or fall in 2012?

Over the last 12 months, several key measures of inflation have shown increases: CPI (Consumer Price Index) rose 3.4%, the median CPI increased 2.2%, the trimmed-mean CPI increased 2.5%, core CPI (less food and energy) increased 2.2%, and core PCE prices increased 1.6% (Q3 2010 to Q3 2011).

Click on graph for larger image.

Click on graph for larger image.

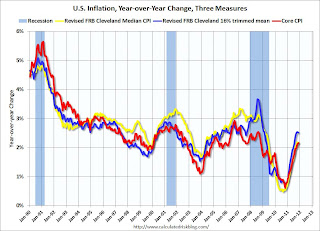

This graph shows core CPI, median CPI and trimmed-mean CPI on a year-over-year basis.

Early in the year there was a spike in energy prices, and it appears there was some spillover into these core measures. However, over the last few months, the rate of inflation has slowed. As an example, core PCE has increased at a 1.5% annual rate over the last 3 months.

In November, on a monthly basis, the median Consumer Price Index increased 1.1% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.0% annualized, and core CPI increased 2.1% annualized.

Also inflation expectations are not indicating a significant increase in inflation. In fact expectations are for further declines in inflation.

Also inflation expectations are not indicating a significant increase in inflation. In fact expectations are for further declines in inflation.

This makes sense because of the slack in the system, and also because deflation is the usual concern following a credit bubble and financial crisis, not inflation.

There are some people who have been predicting an imminent rapid increase in inflation for almost 3 years - in their view, a sharp increase in inflation is always just around the corner. That view has consistently been wrong, although some people also claim the government measures are not correct and that inflation is much higher than reported.

The MIT prices are mostly for goods, because as they note: "The price of services, in particular, are not easy to find online and therefore are not included in our statistics." This is important because, according to the BEA, prices of good have increased significantly faster than the price of services over the last year (Prices for goods have increased 3.9%, and prices for service 1.6% from Q3 2010 to Q3 2011). So, if anything, the MIT prices overstate inflation by excluding most services.

The bottom line is the inflation rate will probably stay low in 2012 with high unemployment and low resource utilization. I expect QE3 to be announced before mid-year, and that will probably keep the inflation rate near the Fed's target (as opposed to falling further). But I don't see inflation as a significant threat in 2012.

Earlier:

• Question #10 for 2012: Monetary Policy