by Calculated Risk on 12/03/2011 11:07:00 AM

Saturday, December 03, 2011

Summary for Week ending Dec 2nd

Expectations are so low that the U.S. economic data last week looked “good”.

Look at the employment report. There were only 120,000 payroll jobs added in November (although September and October were revised up). This is weak employment growth.

Sure the unemployment rate fell sharply, but that was a combination of the household survey showing more jobs added, and a sharp decline in the labor force. Over time the establishment and household surveys mostly move together, but in recent months the household survey has showed stronger job growth than the establishment survey – and the unemployment rate is from the household survey (the establishment survey is the one to use for jobs). Earlier this year the opposite was true; the establishment survey showed more job growth.

There were other signs in the report of sluggish employment growth. The average workweek was unchanged at 34.3 hours, and average hourly earnings decreased slightly. Average hourly earnings have only increased by 1.8% over the past 12 months. This is sluggish earnings growth, and earnings are being impacted by the large number of unemployed and marginally employed workers.

Through the first eleven months of 2011, the economy has added 1.448 million total non-farm jobs or just 131 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.2 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.711 million private sector jobs this year, or about 156 thousand per month.

At a pace of 131 thousand jobs per month, it would take about four more years just to get back to the pre-recession level of payroll jobs. And that doesn’t include population growth. At this stage in a recovery, we’d like to see 300+ thousand jobs added per month.

Another example of “low expectations” was the ISM manufacturing survey. The survey was at 52.7%, the highest level since June – but this is still weak manufacturing growth during a recovery.

Auto sales are increasing sharply, and hit 13.6 million on a seasonally adjusted annual rate (SAAR) basis in November. That is solid compared to recent months and years, but still below the average of over 15 million SAAR from 1984 through 2002 (leaving out the bubble years).

Perhaps the only sector that didn’t beat low expectations was housing. New home sales are moving sideways at a very low level, and house prices are falling again.

Overall the data suggests Q4 real GDP growth will be around 2.5% to 3.0% annualized or so (an early read). That might be the best this year, but it is still slow growth.

Here is a summary in graphs:

• November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

There were only 120,000 payroll jobs added in November. There were 140,000 private sector jobs added, and 20,000 government jobs lost.

The change in total employment was revised up for September and October. "The change in total nonfarm payroll employment for September was revised from +158,000 to +210,000, and the change for October was revised from +80,000 to +100,000."

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.

The household survey showed an increase of 278,000 jobs in November. This increase in the household survey - along with a 315,000 decline in the labor force - pushed the unemployment rate down sharply to 8.6%.

The participation rate fell to 64.0%, and the employment population ratio increased to 58.5%. This is the fourth straight monthly increase in the employment population ratio from the low in July at 58.1%.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This is the worst post WWII employment recession. However, as bad as this is, the Great Depression would be way off the chart. At the worst, employment fell a little over 6% during the recent employment recession - although the data is a little uncertain - employment probably fell by around 22% during the Great Depression.

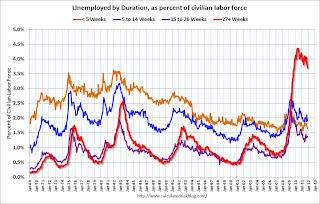

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Only one category increased in November: The "15 to 26 Weeks" group. This is probably spillover from the increase in short term unemployment in August and September. A little bit of good news is that short term unemployment (less than 14 weeks) has declined.

The the long term unemployed declined to 3.7% of the labor force - this is still very high, but the lowest since October 2009. According to the BLS, there are 5.691 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.876 million in October.

According to the BLS employment report, retailers hired seasonal workers at close to the pre-crisis pace in November.

According to the BLS employment report, retailers hired seasonal workers at close to the pre-crisis pace in November.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Retailers hired 423.5 thousand workers (NSA) net in November, and 547.2 thousand in October and November combined. This is more hiring than last year, and this is about the same level as in 2006 and 2007. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season.

• New Home Sales in October: 307,000 SAAR

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was up from a revised 303 thousand in September (revised down from 313 thousand).

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was up from a revised 303 thousand in September (revised down from 313 thousand).This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 60,000 units in October. The combined total of completed and under construction is at the lowest level since this series started.

Sales were slightly below the consensus forecast of 310 thousand, and just above the record low for the month of October set last year (NSA).

New home sales have averaged only 299 thousand SAAR over the 18 months since the expiration of the tax credit ... mostly moving sideways at a very low level.

• ISM Manufacturing index indicates slightly faster expansion in November

PMI was at 52.7% in November, up from 50.8% in October. The employment index was at 51.8%, down from 53.5%, and new orders index was at 56.7%, up from 52.4%.

PMI was at 52.7% in November, up from 50.8% in October. The employment index was at 51.8%, down from 53.5%, and new orders index was at 56.7%, up from 52.4%. From the Institute for Supply Management: November 2011 Manufacturing ISM Report On Business®

Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.7%, and suggests manufacturing expanded at a slightly faster rate in November than in October.

• U.S. Light Vehicle Sales at 13.6 million SAAR in November, Highest since Aug 2009

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.63 million SAAR in November. That is up 11.4% from November 2010, and up 3.1% from the sales rate last month (13.22 million SAAR in Oct 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.63 million SAAR in November. That is up 11.4% from November 2010, and up 3.1% from the sales rate last month (13.22 million SAAR in Oct 2011).This was above the consensus forecast of 13.4 million SAAR. Note: dashed line is current estimated sales rate. This was the highest sales rate since August 2009 ("Cash-for-clunkers"), and other than August 2009, this was the highest since June 2008.

Growth in auto sales should make a strong positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and so far (October and November) sales have averaged 13.42 million SAAR in Q4, an increase of 7.6% over Q3.

• Case Shiller: Home Prices declined in September

From S&P: Home Prices Weaken as the Third Quarter of 2011 Ends

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 32.5% from the peak, and down 0.4% in September (SA). The Composite 10 is 0.5% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 32.5% from the peak, and down 0.6% in September (SA). The Composite 20 is at a new post-bubble low.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.Prices are now falling again, and the Case-Shiller Composite 20 (SA) hit a new post-bubble low.

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

This graph shows the Case-Shiller national index, Composite 20 index, and CoreLogic HPI in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the Case-Shiller national index, Composite 20 index, and CoreLogic HPI in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q1 1999 levels, the Composite 20 index is back to May 2000, and the CoreLogic index back to April 2000.

In real terms, all appreciation in the '00s is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value.

Using a similar method, here is a graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Using a similar method, here is a graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to May 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels and will probably be back to 1999 levels in the next few months.

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

CoreLogic released the Q3 2011 negative equity report this week.

CoreLogic ... today released negative equity data showing that 10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011. This is down slightly from 10.9 million properties, or 22.5 percent, in the second quarter. An additional 2.4 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the third quarter.Here is a graph from the report:

This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic: "Nevada has the highest negative equity percentage with 58 percent of all of its mortgaged properties underwater, followed by Arizona (47 percent), Florida (44 percent), Michigan (35 percent) and Georgia (30 percent). This is the first quarter that Georgia entered the top five, surpassing California which had been in the top five since tracking began in 2009.

The top five states combined have an average negative equity ratio of 41.4 percent, while the remaining states have a combined average negative equity ratio of 17.6 percent."

• Construction Spending increased in October

This morning the Census Bureau reported that overall construction spending increased in October.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 65% below the peak in early 2006, and non-residential spending is 32% below the peak in January 2008.

Public construction spending is now 14% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

• Other Economic Stories ...

• From the NY Fed: Consumer Debt Falls in Third Quarter

• From the Dallas Fed: Texas Manufacturing Activity Declines

• ADP: Private Employment increased 206,000 in November

• From the Chicago ISM Chicago Business Barometer™ Rebounded

• From the NAR: Pending Home Sales Jump in October

• Restaurant Performance Index "essentially unchanged" in October

• Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in October

• Weekly Initial Unemployment Claims increase to 402,000

• LPS: Mortgages In Foreclosure Process at an All-Time High