by Calculated Risk on 1/07/2012 08:05:00 AM

Saturday, January 07, 2012

Summary for Week ending January 6th

A month ago I wrote: "Expectations are so low that the U.S. economic data last week looked 'good'." Not much has changed.

There were only 200,000 payroll jobs added in December. This is better than recent reports, but still weak for a recovery.

The unemployment rate fell again, but that was partially related to another decline in the labor force. There were other signs in the report of sluggish employment growth. The average workweek increased slightly to 34.4 hours, and average hourly earnings increased 0.2%. This is sluggish earnings growth, and earnings are being impacted by the large number of unemployed and marginally employed workers.

For the year, the economy added 1.64 million total non-farm jobs or just 137 thousand per month. This is a better pace of payroll job creation than in 2010, but the economy still has 6.0 million fewer payroll jobs than at the beginning of the 2007 recession. There were 1.92 million private sector jobs added in 2011, or about 160 thousand per month.

At a pace of 137 thousand jobs per month, it would take about 3 1/2 more years just to get back to the pre-recession level of payroll jobs. And that doesn’t include population growth. At this stage in a recovery, we’d like to see 300+ thousand jobs added per month.

Another example of “low expectations” was the ISM manufacturing survey. The survey was at 53.9% in December, the highest level since June – but this is still weak manufacturing growth during a recovery and some of the improvement was probably due to seasonal factors.

Even a 'bright spot' is still weak: Auto sales have been increasing sharply, and were at 13.6 million on a seasonally adjusted annual rate (SAAR) basis in December. That is solid compared to recent months and years, but still below the average of over 15 million SAAR from 1984 through 2002 (leaving out the bubble years).

The US economy is growing, but the growth remains sluggish.

Here is a summary in graphs:

• December Employment Report: 200,000 Jobs, 8.5% Unemployment Rate

There were 200,000 payroll jobs added in December. This included 212,000 private sector jobs added, and 12,000 government jobs lost.

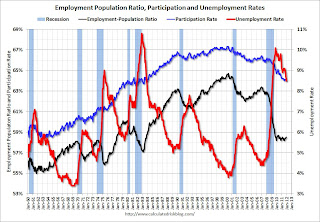

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.

The unemployment rate declined to 8.5% (red line).

The Labor Force Participation Rate was unchanged 64.0% in December (blue line). This is the percentage of the working age population in the labor force.

The Employment-Population ratio was unchanged at 58.5% in December (black line).

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This is the worst post WWII employment recession. However, as bad as this is, the Great Depression would be way off the chart. At the worst, employment fell a little over 6% during the recent employment recession - although the data is a little uncertain - employment probably fell by around 22% during the Great Depression.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

All categories are moving down (the less than 5 week category is back to normal levels). The other categories are still high.

The the long term unemployed declined to 3.6% of the labor force - this is still very high, but the lowest since September 2009.

• ISM Manufacturing index indicates faster expansion in December

PMI was at 53.9% in December, up from 52.7% in November. The employment index was at 55.1%, up from 51.8%, and new orders index was at 57.6%, up from 56.7%.

PMI was at 53.9% in December, up from 52.7% in November. The employment index was at 55.1%, up from 51.8%, and new orders index was at 57.6%, up from 56.7%. From the Institute for Supply Management: December 2011 Manufacturing ISM Report On Business®

Here is a long term graph of the ISM manufacturing index. This was above expectations of 53.2%, and suggests manufacturing expanded at a faster rate in December than in November.

• U.S. Light Vehicle Sales at 13.56 million SAAR in December

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.56 million SAAR in December. That is up 8.9% from December 2010, and down 0.3% from the sales rate last month (13.60 million SAAR in Nov 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.56 million SAAR in December. That is up 8.9% from December 2010, and down 0.3% from the sales rate last month (13.60 million SAAR in Nov 2011).This was at the consensus forecast of 13.6 million SAAR. Note: dashed line is current estimated sales rate.

Growth in auto sales should make a strong positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and sales averaged 13.46 million SAAR in Q4, an increase of 8.1% over Q3.

• Construction Spending increased in November

"Construction spending during November 2011 was estimated at a seasonally adjusted annual rate of $807.1 billion, 1.2 percent above the revised October estimate of $797.4 billion."

"Construction spending during November 2011 was estimated at a seasonally adjusted annual rate of $807.1 billion, 1.2 percent above the revised October estimate of $797.4 billion."This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64% below the peak in early 2006, and non-residential spending is 33% below the peak in January 2008.

Public construction spending is now 12% below the peak in March 2009.

This graph shows the year-over-year change in construction spending.

This graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

• ISM Non-Manufacturing Index indicates slightly faster expansion in December

The December ISM Non-manufacturing index was at 52.6%, up from 52.0% in November. The employment index increased in December to 49.4%, up from 48.9% in November. Note: Above 50 indicates expansion, below 50 contraction.

The December ISM Non-manufacturing index was at 52.6%, up from 52.0% in November. The employment index increased in December to 49.4%, up from 48.9% in November. Note: Above 50 indicates expansion, below 50 contraction. From the Institute for Supply Management: December 2011 Non-Manufacturing ISM Report On Business®

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.4% and indicates slightly faster expansion in December than in November.

• Weekly Initial Unemployment Claims decline to 372,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 373,250.

This is the lowest level for the 4-week average since June 2008.

• Reis: Apartment Vacancy Rate falls to 5.2% in Q4, Lowest since 2001

Reis reported that the apartment vacancy rate (82 markets) fell to 5.2% in Q4 from 5.6% in Q3. The vacancy rate was at 6.6% in Q4 2010 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate (82 markets) fell to 5.2% in Q4 from 5.6% in Q3. The vacancy rate was at 6.6% in Q4 2010 and peaked at 8.0% at the end of 2009.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

• Reis: Office Vacancy Rate declines slightly in Q4 to 17.3%

This graph shows the office vacancy rate starting in 1991.

This graph shows the office vacancy rate starting in 1991.Reis is reporting the vacancy rate declined to 17.3% in Q4, down from 17.4% in Q3. The vacancy rate was at a cycle high of 17.6% in Q3 and Q4 2010. It appears the office vacancy rate peaked in 2010 and is declining very slowly.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.

• Other Economic Stories ...

• From the Federal Reserve: The U.S. Housing Market: Current Conditions and Policy Considerations

• FOMC Minutes: Agreement to provide "projections of appropriate monetary policy" in January

• LPS on Mortgages: "Trend toward fewer loans becoming delinquent has halted"

• AAR: Rail Traffic increased 7.3 percent YoY in December

• A few key dates for Europe