by Calculated Risk on 2/02/2012 11:08:00 AM

Thursday, February 02, 2012

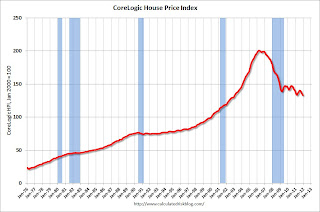

CoreLogic: House Price Index declined 1.4% in December to new post-bubble low

Notes: This CoreLogic House Price Index report is for December. The Case-Shiller index released last week was for November. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of September, October and November (November weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Prices fell by 4.7 percent nationally in 2011

The CoreLogic HPI shows that, including distressed sales, home prices in the U.S. decreased 4.7 percent in 2011 compared with December 2010. This year-end report shows that home prices continued the trend of year-end decreases—this is the fifth consecutive year with a decrease in the HPI. The HPI excluding distressed sales shows that home prices decreased by 0.9 percent in 2011, giving an indication of the impact of distressed sales on home prices in 2011.

The report also shows that national home prices including distressed sales decreased 1.4 percent on a month-over-month basis, the fifth consecutive monthly decline. However, the HPI excluding distressed sales posted its first month-over-month gain since July 2011, rising 0.2 percent.

“While overall prices declined by almost 5 percent in 2011, non-distressed prices showed only a small decrease. Until distressed sales in the market recede, we will see continued downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.4% in December, and is down 4.7% over the last year.

The index is off 33.7% from the peak - and is now at a new post-bubble low.

Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March 2012. Last year prices fell about 4% from December 2010 to March 2011, and there will probably be a similar decline this year.