by Calculated Risk on 3/11/2012 01:31:00 PM

Sunday, March 11, 2012

Distressed House Sales using Sacramento Data for February

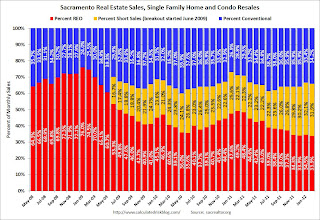

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes significantly. So far there has been a shift from REO to short sales, and the percentage of distressed sales has been declining gradually year-over-year. The percent of distressed sales in Sacramento decreased in February compared January; the normal seasonal pattern. Usually January has the largest percentage of short sales for the year.

In February 2012, 65.8% of all resales (single family homes and condos) were distressed sales. This was down from 71.2% in February 2011, and the lowest percentage of February distressed sales since Sacramento started breaking out the data.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

There will be probably be more foreclosures following the mortgage servicer settlement, but it is possible the percent of conventional sales will be over 40% this summer for the first time since the crisis started.

Total sales were up 14.2% compared to February 2011. Active Listing Inventory declined 54.3% from last February, and total inventory, including "short sale contingent", was off 30% year-over-year.

Cash buyers accounted for 33.7% of all sales (frequently investors), and median prices are off 5.3% from last February.

This data might be helpful in determining when the market is improving. So far it looks like REO sales have declined, partially offset by an increase in short sales, and a small decline in the total percent of distressed sales. Also inventory has plummeted - even inventory including "short sale contingent" listings.