by Calculated Risk on 3/09/2012 10:22:00 AM

Friday, March 09, 2012

Employment Summary and Discussion

This was a solid report, especially considering the upward revisions to payrolls for December and January. The better than normal weather helped, and there is still a long ways to go for a healthy labor market with solid wage gains.

Some analysts are comparing the last three months of payroll growth to early 2011, and arguing job growth will disappoint in the coming months. I also expect some slowing in employment growth since nice weather helps the most during the winter months. But there are reasons to expect better job growth overall this year - remember 2011 was negatively impacted by the tsunami, bad weather, high oil prices and the debt ceiling debate. We can't predict the weather, and oil prices are high again - but hopefully there will be no natural disasters, and also no threats of defaulting on the debt.

Plus housing has made the bottom turn, and even with a sluggish housing recovery, residential investment will add to economic growth in 2012. Also, the employment losses from state and local governments will probably end mid-year. In the last 6 months of 2011, there were 119,000 government jobs lost. This year, in the second half, job losses will probably be close to zero. As the BLS noted:

Government employment was essentially unchanged in January and February. In 2011, government lost an average of 22,000 jobs per month.On to the report: There were 227,000 payroll jobs added in February, with 233,000 private sector jobs added, and 6,000 government jobs lost. The unemployment rate was unchanged at 8.3%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.9% from 15.1% in January. This remains very high - U-6 was in the 8% range in 2007 - but this is the lowest level of U-6 since January 2009.

The participation rate increased to 63.9% (from 63.7%) and the employment population ratio increased slightly to 58.6%.

The change in December payroll employment was revised up from +203,000 to +223,000, and January was revised up from +243,000 to +284,000.

The average workweek was unchanged at 34.5 hours, and average hourly earnings increased 0.1%. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.5 hours in February. ... In February, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents, or 0.1 percent, to $23.31. Over the past 12 months, average hourly earnings have increased by 1.9 percent." This is sluggish earnings growth, and earnings are still being impacted by the large number of unemployed and marginally employed workers.

There are a total of 12.8 million Americans unemployed and 5.4 million have been unemployed for more than 6 months. Still very grim.

But overall this was a solid report.

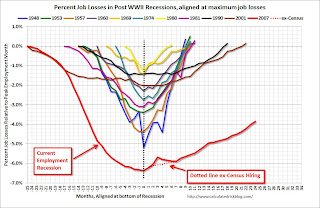

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report: The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 8.1 million in February. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decreased slightly in February and is still very high.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 14.9% in February from 15.1% in January.

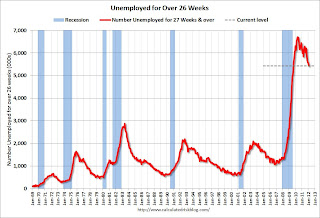

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.426 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.518 million in January. This is very high, but this is the lowest number since January 2009.

When the number of long term unemployed and part time workers (for economic reasons) starts to fall sharply, and wages increase faster than inflation, this will feel much more like a recovery.

More graphs coming ...