by Calculated Risk on 3/31/2012 01:05:00 PM

Saturday, March 31, 2012

Schedule for Week of April 1st

Earlier:

• Summary for Week Ending March 30th

The key report for this week will be the March employment report to be released on Friday, Apr 6th. Other key reports include the ISM manufacturing index on Monday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Wednesday. The FOMC minutes for the March meeting will be released on Tuesday.

Note: Reis is expected to release their Q1 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, a slight decline in vacancy rates for regional malls, and a slight decline in the office vacancy rate.

10:00 AM ET: ISM Manufacturing Index for March.

10:00 AM ET: ISM Manufacturing Index for March. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight increase to 53.0 from 52.4 in February.

10:00 AM: Construction Spending for February. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for March. Light vehicle sales are expected to decline to 14.7 million from 15.0 million in February (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate. TrueCar is forecasting:

The March 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 14.5 million new car sales, up from 13.1 million in March 2011 and down from 15.1 million in February 2012Edmund.com is forecasting:

Edmunds.com estimates that 1,451,956 new cars will be sold in March, for a projected Seasonally Adjusted Annual Rate (SAAR) of 14.9 million units. The projected sales results would be a 26.4 percent increase over February 2012 and a 16.5 percent increase over March 2011.10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 1.5% increase in orders.

2:00 PM: FOMC Minutes, Meeting of March 13th. The minutes might include a discussion of possible easing options.

4:05 PM: San Francisco Fed President John Williams speaks on the economy to students at University of San Diego.

Early: Reis Q1 2012 Apartment vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 208,000 payroll jobs added in March, down from the 216,000 reported last month.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a decrease to 56.7 from 57.3 in February. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a decrease to 56.7 from 57.3 in February. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Early: Reis Q1 2012 Office vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to essentially unchanged at 360,000.

Markets will be closed in observance of Good Friday.

Early: Reis Q1 2012 Mall vacancy rates.

8:30 AM: Employment Report for March. The consensus is for an increase of 201,000 non-farm payroll jobs in March, down from the 227,000 jobs added in February.

8:30 AM: Employment Report for March. The consensus is for an increase of 201,000 non-farm payroll jobs in March, down from the 227,000 jobs added in February.The consensus is for the unemployment rate to remain unchanged at 8.3%.

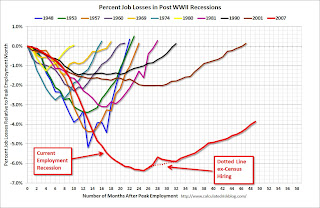

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through February.

The economy has added 3.45 million jobs since employment bottomed in February 2010 (3.94 million private sector jobs added, and 490 thousand public sector jobs lost).

The economy has added 3.45 million jobs since employment bottomed in February 2010 (3.94 million private sector jobs added, and 490 thousand public sector jobs lost).There are still 4.9 million fewer private sector jobs now than when the recession started. (5.3 million fewer total nonfarm jobs).

3:00 PM: Consumer Credit for February. The consensus is for a $12.0 billion increase in consumer credit.