by Calculated Risk on 4/24/2012 09:00:00 AM

Tuesday, April 24, 2012

Case Shiller: House Prices fall to new post-bubble lows in February NSA

S&P/Case-Shiller released the monthly Home Price Indices for February (a 3 month average of December, January and February).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Nine Cities and Both Composites Hit New Lows in February 2012 According to the S&P/Case-Shiller Home Price Indices

Data through February 2012, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed annual declines of 3.6% and 3.5% for the 10- and 20-City Composites, respectively. This is an improvement over the annual rates posted for the month of January, -4.1% and -3.9%, respectively. ... Nine MSAs and both Composites posted new cycle lows as of February 2012.

...

“While there might be pieces of good news in this report, such as some improvement in many annual rates of return, February 2012 data confirm that, broadly-speaking, home prices continued to decline in the early months of the year,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Nine MSAs -- Atlanta, Charlotte, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle and Tampa -- and both Composites hit new post-crisis lows. Atlanta continued its downward spiral, posting its lowest annual rate of decline in the 20-year history of the index at -17.3%. The 10-City Composite declined 3.6% and the 20-City was down 3.5% compared to February 2011.

Click on graph for larger image.

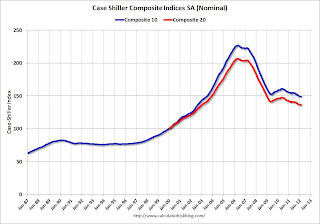

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.2% from the peak, and up 0.2% in February (SA). The Composite 10 is at a new post bubble low Not Seasonally Adjusted.

The Composite 20 index is off 33.9% from the peak, and up 0.1% (SA) from January. The Composite 20 is also at a new post-bubble low NSA.

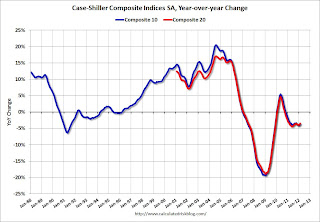

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.6% compared to February 2011.

The Composite 20 SA is down 3.4% compared to February 2011. This was a smaller year-over-year decline for both indexes than in January.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 12 of the 20 Case-Shiller cities in February seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.7% from the peak, and prices in Dallas only off 8.2% from the peak.

Prices increased (SA) in 12 of the 20 Case-Shiller cities in February seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.7% from the peak, and prices in Dallas only off 8.2% from the peak.The NSA indexes are at new post-bubble lows - and the NSA indexes will continue to decline in March (this report was for the three months ending in February). I'll have more on prices later