by Calculated Risk on 5/26/2012 08:01:00 AM

Saturday, May 26, 2012

Summary for Week of May 25th

Housing remains weak, but improving. The Census Bureau reported that new home sales increased again in April, and that there were 117,000 new homes sold during the first four months of 2012. This compares to only 101,000 sold for the comparable period last year. This level of sales is historically very weak - and 2012 will probably be the 3rd worst year on record after 2011 and 2010 - but the increase in sales is important for both jobs and economic growth.

For existing home sales, the key number is inventory. The NAR reported that inventory increased seasonally in April, but that inventory is down 20.6% from last April. Less listed inventory means less downward pressure on prices, and some preliminary data suggests house prices may have stabilized. We will have more data on house prices next week.

Also consumer sentiment improved in May, probably because of the recent decline in gasoline prices.

There were some negatives too: Europe is a mess, durable goods orders were soft, the Richmond Fed manufacturing survey showed slower expansion, and the trucking index declined. But this was a week for housing data, and housing is slowly recovering. Here are some comments from home builder Toll Brothers CEO Doug Yearly, Jr this week:

"It appears that the housing market has moved into a new and stronger phase of recovery as we have experienced broad-based improvement across most of our regions over the past six months. The spring selling season has been the most robust and sustained since the downturn began. Even now, for the first three weeks of May, our non-binding reservation deposits, a leading indicator of future contracts, are running 39% ahead on a gross basis, and 23% ahead on a per-community basis, compared to last year's same May period."I always take home builder comments with a grain of salt, but that is a pretty strong statement.

Here is a summary in graphs:

• New Home Sales increase in April to 343,000 Annual Rate

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The Census Bureau reported New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 343 thousand.

This was up from a revised 332 thousand SAAR in March (revised up from 328 thousand).

The second graph shows New Home Months of Supply.

The second graph shows New Home Months of Supply.Months of supply decreased to 5.1 in April from 5.2 in March.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.The inventory of completed homes for sale was at a record low 46,000 units in April. The combined total of completed and under construction is at the lowest level since this series started.

Even though sales are still very low, new home sales have clearly bottomed. New home sales have averaged 340 thousand SAAR over the last 5 months, after averaging under 300 thousand for the previous 18 months. All of the recent revisions have been up too.

• Existing Home Sales in April: 4.62 million SAAR, 6.6 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in April 2012 (4.62 million SAAR) were 3.4% higher than last month, and were 10.00% above the April 2011 rate.

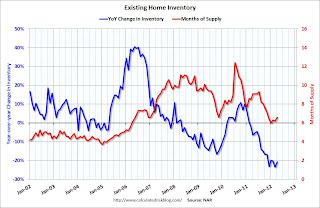

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in April from April 2011. This is the fourteenth consecutive month with a YoY decrease in inventory.Months of supply was increased to 6.6 months in April.

The NAR reported inventory increased to 2.54 million units in April, up 9.5% from the downwardly revised 2.32 million in March (revised down from 2.40 million).

• Q1 REO inventory of "the F's", PLS, and FDIC-insured institutions combined down about 20% from a year ago

From economist Tom Lawler: "FDIC released its Quarterly Banking Profile for the first quarter of 2012, and according to the report the carrying value of 1-4 family REO properties at FDIC-insured institutions at the end of March was $11.0819 billion, down from $11.6736 billion at the end of December and $13.2795 billion at the end of March. FDIC does not release institutions’ REO inventory by property count. If FDIC institutions’ average carrying value were 50% higher than the average for Fannie and Freddie, then the number of 1-4 family REO properties at the end of March at FDIC institutions would be about 89,398, down from 93,215 at the end of December and 100,530 at the end of last March.

From economist Tom Lawler: "FDIC released its Quarterly Banking Profile for the first quarter of 2012, and according to the report the carrying value of 1-4 family REO properties at FDIC-insured institutions at the end of March was $11.0819 billion, down from $11.6736 billion at the end of December and $13.2795 billion at the end of March. FDIC does not release institutions’ REO inventory by property count. If FDIC institutions’ average carrying value were 50% higher than the average for Fannie and Freddie, then the number of 1-4 family REO properties at the end of March at FDIC institutions would be about 89,398, down from 93,215 at the end of December and 100,530 at the end of last March.Using this assumption, here is a chart showing SF REO inventory for Fannie, Freddie, FHA, private-label ABS, and FDIC-insured institutions. The estimated total for this group in March was 450,194, down 19.9% from last March."

• Weekly Initial Unemployment Claims essentially unchanged at 370,000

This graph shows the 4-week moving average of weekly claims.

This graph shows the 4-week moving average of weekly claims.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 370,000.

The 4-week average has declined for three consecutive weeks. The average has been between 363,000 and 384,000 all year.

This was close the consensus forecast of 371,000.

• Consumer Sentiment increases in May to 79.3

The final Reuters / University of Michigan consumer sentiment index for May increased to 79.3, up from the preliminary reading 77.8, and up from the April reading of 76.4.

The final Reuters / University of Michigan consumer sentiment index for May increased to 79.3, up from the preliminary reading 77.8, and up from the April reading of 76.4.This was above the consensus forecast of 77.8 and the highest level since October 2007 - before the recession started. Overall sentiment is still fairly weak - probably due to a combination of the high unemployment rate, high gasoline prices and the sluggish economy - but falling gasoline prices probably helped in May.

• Other Economic Stories ...

• Chicago Fed: Economic growth near historical trend in April

• DOT: Vehicle Miles Driven increased 0.9% in March

• LPS: Mortgage delinquencies increased slightly in April

• ATA Trucking index declined 1.1% in April

• FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q1