by Calculated Risk on 6/30/2012 01:05:00 PM

Saturday, June 30, 2012

Schedule for Week of July 1st

Earlier:

• Summary for Week Ending June 29th

The key report for this week will be the June employment report to be released on Friday, July 6th. Other key reports include the ISM manufacturing index on Monday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Thursday.

The European Central Bank (ECB) holds a meeting on Thursday and is expected to cut the benchmark interest rate from 1.0% to 0.75%.

Happy Independence Day on Wednesday!

Reis will release their Q2 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, a decline in vacancy rates for regional malls, and a slight decline in the office vacancy rate.

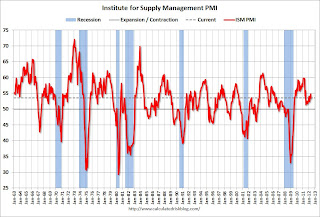

10:00 AM ET: ISM Manufacturing Index for June.

10:00 AM ET: ISM Manufacturing Index for June. Here is a long term graph of the ISM manufacturing index. The consensus is for a decrease to 52.0 from 53.5 in May.

10:00 AM: Construction Spending for May. The consensus is for a 0.2% increase in construction spending.

Early: Reis Q2 2012 Office vacancy rates.

All day: Light vehicle sales for June. Light vehicle sales are expected to increase to 13.9 million from 13.8 million in May (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate. TrueCar is forecasting:

The June 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 13.6 million new car sales, up from 11.5 million in June 2011 and down from 13.8 million in May 2012Edmunds.com is forecasting:

[A]n estimated Seasonally Adjusted Annual Rate (SAAR) this month of 13.9 million light vehicles, according to Edmunds.com.10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 0.1% increase in orders.

10:00 AM: Trulia Price & Rent Monitors for June. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

SIFMA recommends US markets close at 2:00 PM ET in advance of the Independence Day Holiday on July 4th.

All US markets will be closed in observance of the Independence Day holiday.

Early: Reis Q2 2012 Apartment vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Refinance activity has increased sharply, and it appears purchase activity is increasing a little too.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 95,000 payroll jobs added in June, down from the 133,000 reported last month.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 386 thousand.

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a decrease to 53.0 from 53.7 in May. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a decrease to 53.0 from 53.7 in May. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Early: Reis Q2 2012 Mall vacancy rates.

8:30 AM: Employment Report for June. The consensus is for an increase of 90,000 non-farm payroll jobs in June, up from the 69,000 jobs added in May.

8:30 AM: Employment Report for June. The consensus is for an increase of 90,000 non-farm payroll jobs in June, up from the 69,000 jobs added in May.The consensus is for the unemployment rate to remain unchanged at 8.2%.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through May.

The economy has added 3.77 million jobs since employment bottomed in February 2010 (4.27 million private sector jobs added, and 502 thousand public sector jobs lost).

The economy has added 3.77 million jobs since employment bottomed in February 2010 (4.27 million private sector jobs added, and 502 thousand public sector jobs lost).There are still 4.7 million fewer private sector jobs now than when the recession started in 2007. (5.0 million fewer total nonfarm jobs).