by Calculated Risk on 7/12/2012 03:05:00 PM

Thursday, July 12, 2012

CoreLogic: Negative Equity Decreases in Q1 2012

From CoreLogic: CORELOGIC® Reports Negative Equity Decreases in First Quarter of 2012

CoreLogic ... today released new data showing that 11.4 million, or 23.7 percent, of all residential properties with a mortgage were in negative equity at the end of the first quarter of 2012. This is down from 12.1 million properties, or 25.2 percent, in the fourth quarter of 2011. An additional 2.3 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the first quarter.Note: CoreLogic revised their methodology, and they provided revised historical data here.

Together, negative equity and near-negative equity mortgages accounted for 28.5 percent of all residential properties with a mortgage nationwide in the first quarter, down from 30.1 percent in Q4 2011. More than 700,000 households regained a positive equity position in the Q1 2012. Nationally, negative equity decreased from $742 billion in Q4 2011 to $691 billion in the first quarter, a fall of $51 billion in large part due to an improvement in house price levels.

“In the first quarter of 2012, rebounding home prices, a healthier balance of real estate supply and demand, and a slowing share of distressed sales activity helped to reduce the negative equity share,” said Mark Fleming, chief economist for CoreLogic. “This is a meaningful improvement that is driven by quickly improving outlooks in some of the hardest hit markets. While the overall stagnating economic recovery will likely slow housing market recovery in the second half of this year, reducing the number of underwater households is an important step toward reducing future mortgage default risk.”

Click on graph for larger image.

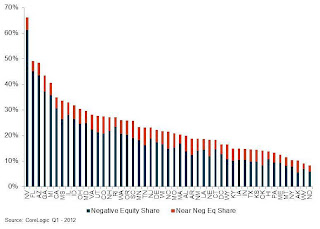

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest negative equity percentage with 61 percent of all mortgaged properties underwater, followed by Florida (45 percent), Arizona (43 percent), Georgia (37 percent) and Michigan (35 percent). These top five states combined have an average negative equity share of 44.5 percent, while the remaining states have a combined average negative equity share of 15.9 percent."

The second graph shows the historical negative equity share using the new CoreLogic methodology.

The second graph shows the historical negative equity share using the new CoreLogic methodology.More from CoreLogic: "As of Q1 2012, there were 1.9 million borrowers who were only 5 percent underwater. If home prices continue increasing over the next year, these borrowers could move out of a negative equity position."

This is some improvement, but there are still 11.4 residential properties with negative equity.