by Calculated Risk on 7/27/2012 12:10:00 PM

Friday, July 27, 2012

Q2 GDP: Comments and Investment

The Q2 GDP report was weak, but slightly better than expected. Final demand weakened in Q2 as personal consumption expenditures increased at only a 1.5% annual rate, and residential investment increased at a 9.7% annual rate.

Investment in equipment and software picked up slightly to a 7.2% annual rate in Q2, and investment in non-residential structures was only slightly positive. The details will be released next week, but most of the recent positive increases in non-residential structures has been from investment in energy and power structures. Based on the architecture billing index, I expect the drag from other non-residential categories (offices, malls, hotels) to continue all year.

And there was another negative contribution from government spending at all levels. However, it appears the drag from state and local governments will end soon (after declining for almost 3 years).

Overall this was another weak report indicating sluggish growth.

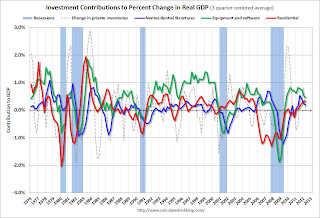

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q2 for the fifth consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing. The good news: Residential investment has clearly bottomed.

The contribution from RI will probably continue to be sluggish compared to previous recoveries, but the ongoing positive contribution to GDP is a significant story.

Equipment and software investment has made a positive contribution to GDP for twelve straight quarters (it is coincident).

The contribution from nonresidential investment in structures was slightly positive in Q2. Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

Residential Investment as a percent of GDP is still near record lows, but it is increasing. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Residential Investment as a percent of GDP is still near record lows, but it is increasing. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units.

Last year the increase in RI was mostly from multifamily and home improvement investment. Now the increase is from most categories including single family. I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue all year (although the recovery in RI will be sluggish compared to previous recoveries). Since RI is the best leading indicator for the economy, this suggests no recession this year.

Earlier with revision graphs:

• Real GDP increased 1.5% annual rate in Q2