by Calculated Risk on 7/26/2012 06:33:00 PM

Thursday, July 26, 2012

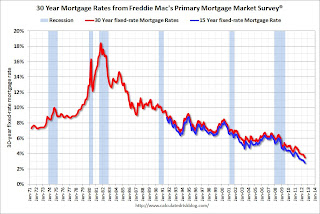

Record Low Mortgage Rates and Increasing Refinance Activity

Another month, another record ...

Below is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

The the MBA reported yesterday that refinance activity was at the highest level since 2009.

And from Freddie Mac today: 30-Year Fixed-Rate Mortgage Averages a Record-Breaking 3.49 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgages rates continuing their streak of record-breaking lows. The 30-year fixed rate mortgage averaged 3.49 percent, more than a full percentage point lower than a year ago when it averaged 4.55 percent. Meanwhile, the 15-year fixed-rate mortgage, a popular choice for those looking to refinance, also set another record low at 2.80 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently at the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a significant refinance boom, and rates have fallen about 75 bps from the 4.23% low in October 2010 - and refinance activity is picking up.

There has also been an increase in refinance activity due to HARP.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). Both rates are at record lows for the Freddie Mac survey. Rates for 15 year fixed loans are now at 2.8%.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey. The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). Both rates are at record lows for the Freddie Mac survey. Rates for 15 year fixed loans are now at 2.8%.Note: The Ten Year treasury yield is just off the record low at 1.43% (the record low was earlier this week at 1.39%), so rates will probably fall a little more next week.