by Calculated Risk on 7/14/2012 12:45:00 PM

Saturday, July 14, 2012

Schedule for Week of July 15th

Earlier:

• Summary for Week Ending July 13th

This will be a very busy week for economic data. Key reports include retail sales, housing starts, and existing home sales for June.

For manufacturing, the Fed will release the June Industrial Production and Capacity Utilization, and two regional surveys will be released for July (the first look at manufacturing in July).

On prices, CPI will be released on Tuesday.

Investors will focus on Fed Chairman Ben Bernanke's testimony on Tuesday and Wednesday for hints about QE3.

8:30 AM ET: Retail Sales for June.

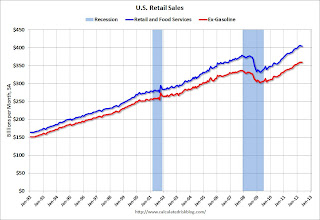

8:30 AM ET: Retail Sales for June. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 22.1% from the bottom, and now 6.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.2% in June, and for retail sales ex-autos to increase 0.l%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for July. The consensus is for a reading of 4.5, up from 2.3 in June (above zero is expansion).

10:00 AM: Manufacturing and Trade: Inventories and Sales for May (Business inventories). The consensus is for 0.3% increase in inventories.

8:30 AM: Consumer Price Index for June. The consensus is for headline CPI to be unchanged in June. The consensus is for core CPI to increase 0.2%.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for June.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.3% in June, and for Capacity Utilization to increase to 79.2%.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 30, up slightly from 29 in June. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Housing Starts for June.

8:30 AM: Housing Starts for June. Total housing starts were at 708 thousand (SAAR) in May, down 4.8% from the revised April rate of 744 thousand (SAAR). Note that April was revised up from 717 thousand. March was revised up too.

The consensus is for total housing starts to increase to 745,000 (SAAR) in June from 708,000 in May.

10:00 AM: Testimony, Fed Chairman Ben Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This will receive extra attention this month as investors look for signs of a slowdown.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.65 million on seasonally adjusted annual rate (SAAR) basis, up from 4.55 million in May.

A key will be inventory and months-of-supply.

10:00 AM: Philly Fed Survey for July. The consensus is for a reading of -8.0, up from -16.6 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for June. The consensus is for a 0.1% decrease in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for June 2012