by Calculated Risk on 7/21/2012 08:01:00 AM

Saturday, July 21, 2012

Summary for Week ending July 20th

For the last few months, the economic data has been weak and disappointing. Last week I joked: "Luckily there are a few housing reports next week, so all the data will not be grim.", and sure enough the housing data was better than expected (still historically weak, but definitely improving).

Housing started the week off with July home builder confidence at the highest level since March 2007. Then housing starts for June were reported at 760 thousand, and finally the existing home sales report showed the largest year-over-year decline in inventory ever reported. (Sales were weaker than expected, but the key number in the NAR report is inventory).

Unfortunately some non-housing economic data was released too. Retail sales were especially weak in June, initial weekly unemployment claims increased sharply, the Architecture Billings Index (mostly commercial real estate) showed further contraction, and the regional manufacturing surveys suggested ongoing weakness in July.

There were a couple of non-housing positives: Industrial production was up in June, and inflation was benign.

Luckily there is another housing report next week: June New Home sales. But the key report next week will be Q2 GDP - and that will be UGLY (update: around 1%).

Here is a summary of last week in graphs:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 760 thousand (SAAR) in June, up 6.9% from the revised May rate of 711 thousand (SAAR). Note that May was revised up from 708 thousand. April was revised up slightly too.

Single-family starts increased 4.7% to 539 thousand in June.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

Total starts are up 59% from the bottom start rate, and single family starts are up 53% from the low.

This was above expectations of 745 thousand starts in June. This is another fairly strong housing report.

• Existing Home Sales in June: 4.37 million SAAR, 6.6 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in June 2012 (4.37 million SAAR) were 5.4% lower than last month, and were 4.5% above the June 2011 rate.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.

Inventory decreased 24.4% year-over-year in June from June 2011. This is the sixteenth consecutive month with a YoY decrease in inventory, and the largest year-over-year decline reported.Months of supply increased to 6.6 months in June.

This was below expectations of sales of 4.65 million. However, as I've noted before, those focusing on sales of existing homes, looking for a recovery for housing, are looking at the wrong number. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• Retail Sales declined 0.5% in June

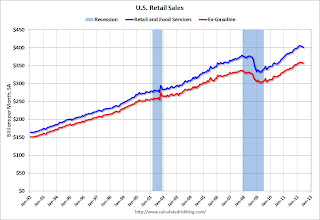

On a monthly basis, retail sales were down 0.5% from May to June (seasonally adjusted), and sales were up 3.8% from June 2011.

On a monthly basis, retail sales were down 0.5% from May to June (seasonally adjusted), and sales were up 3.8% from June 2011.Sales for May were unchanged at a 0.2% decrease.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 21.2% from the bottom, and now 6.0% above the pre-recession peak (not inflation adjusted)

The next graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.2% on a YoY basis (3.8% for all retail sales). Retail sales ex-gasoline decreased 0.3% in June.

Retail sales ex-gasoline increased by 4.2% on a YoY basis (3.8% for all retail sales). Retail sales ex-gasoline decreased 0.3% in June.This was below the consensus forecast for retail sales of a 0.2% increase in June, and below the consensus for a 0.1% increase ex-auto.

Some of the decrease was related to the decline in gasoline prices, but this is another indicator of a weak June.

• Industrial Production increased 0.4% in June, Capacity Utilization increased

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization Industrial production increased 0.4 percent in June after having declined 0.2 percent in May. ... Capacity utilization for total industry moved up 0.2 percentage point in June to 78.9 percent, a rate 1.4 percentage points below its long-run (1972--2011) average.This graph shows Capacity Utilization. This series is up 12.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is still 1.4 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in June to 97.4. This is 16.7% above the recession low, but still 3.3% below the pre-recession peak.

The consensus is for Industrial Production to increase 0.3% in June, and for Capacity Utilization to increase to 79.2%. The increase IP was slightly above expectations, but Capacity Utilization was below expectations.

• AIA: Architecture Billings Index shows "drop in design activity" in June

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Weak Market Conditions Persist According to Architecture Billings Index

From AIA: Weak Market Conditions Persist According to Architecture Billings IndexThis graph shows the Architecture Billings Index since 1996. The index was at 45.9 in June, up slightly from May. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims increase to 386,000

Here is a long term graph of weekly claims:

Here is a long term graph of weekly claims:The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 375,500.

The sharp decline last week due to onetime factors, and some increase was expected.

This was well above the consensus forecast of 365,000 and suggests ongoing weakness in the labor market.

• Regional Manufacturing Surveys

From the NY Fed: Empire State Manufacturing Survey

From the NY Fed: Empire State Manufacturing Survey The general business conditions index rose five points to 7.4. New orders, however, declined, as that index slipped into negative territory for the first time since November 2011, falling five points to -2.7.From the Philly Fed: July 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of −16.6 in June to −12.9. This marks the third consecutive negative reading for the index ...Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys increased in July, but the average is still negative (contraction).

• Other Economic Stories ...

• NAHB Builder Confidence increases strongly in July, Highest since March 2007

• First Look at 2013 Cost-Of-Living Adjustments and Maximum Contribution Base

• Bernanke: Semiannual Monetary Policy Report to the Congress

• State Unemployment Rates little changed in June

• Fed's Beige Book: Economic activity increased at "modest to moderate" pace, Residential real estate "largely positive"

• Key Measures show slowing inflation in June