by Calculated Risk on 8/11/2012 08:01:00 AM

Saturday, August 11, 2012

Summary for Week ending Aug 10th

Note: For amusement, here are the original Ryan plan projections. Enjoy. Note: I know numbers, and these are hilarious (look at the unemployment rate and residential investment). I saved these immediately after they were released because I expected them to be changed or deleted. They quickly disappeared.

The few economic releases this week were mostly a little more upbeat than we’ve seen recently.

The trade deficit declined in June as exports increased and oil prices declined. Also - so far - there is little evidence of the Eurozone problems significantly impacting US exports to the euro area. Another positive was the decline in initial weekly unemployment claims. The 4-week average of unemployment claims is near the low for the year, and might signal a little improvement in the labor market.

For housing, CoreLogic reported a 2.5% year-over-year increase in house prices, and both Fannie and Freddie credit the increase in house prices for their improved results. The slight increase in house prices, along with the ongoing, albeit sluggish recovery in housing is having a positive impact on the economy.

Here is the summary from Jan Hatzius, chief economist at Goldman Sachs:

“We expect a moderate pickup in US growth from the dreary 1%-1½% pace of the past few months. The data released this week, while sparse, were consistent with our view. Jobless claims logged a surprise decline, which looks potentially meaningful now that the seasonal adjustment distortions related to the summer auto shutdowns are behind us. The June wholesale inventory report showed much less accumulation than expected, which explains some of the recent weakness in the goods-producing sector and should be positive for the near-term production outlook. Combined with a narrowing of the June trade deficit, this boosted our Q3 GDP estimate to 2.2%, compared with 2.0% at the start of the week."Here is a summary of last week in graphs:

• Trade Deficit declined in June to $42.9 Billion

Click on graph for larger image.

Click on graph for larger image.The Department of Commerce reported:

"[T]otal June exports of $185.0 billion and imports of $227.9 billion resulted in a goods and services deficit of $42.9 billion, down from $48.0 billion in May, revised. June exports were $1.7 billion more than May exports of $183.3 billion. June imports were $3.5 billion less than May imports of $231.4 billion."

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $100.13 in June, down from $107.91 per barrel in May. The decline in oil prices contributed to the overall decline in the trade deficit. The trade deficit with China increased to $27.4 billion in June, up from $26.6 billion in June 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $17.4 billion in June, up from $16.4 billion in June 2011; so the euro area recession didn't lead to less US exports to the euro area in June.

• MBA: Mortgage Delinquencies increased in Q2

The MBA reported that 11.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2012 (delinquencies seasonally adjusted). This is up slightly from 11.79 percent in Q1 2012. This graph shows the percent of loans delinquent by days past due.

The MBA reported that 11.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2012 (delinquencies seasonally adjusted). This is up slightly from 11.79 percent in Q1 2012. This graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.The top states are Florida (13.70% in foreclosure down from 14.31% in Q1), New Jersey (7.65% down from 8.37%), Illinois (7.11% down from 7.46%), New York (6.47% up from 6.17%) and Nevada (the only non-judicial state in the top 13 at 6.09% down from 6.47%).

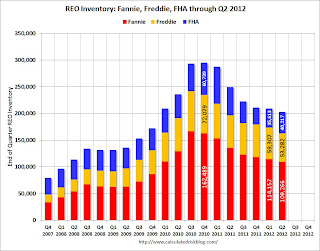

• Fannie, Freddie, FHA REO declined 18% Year-over-year

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 202,765 at the end of Q2 2012, down from 209,077 in Q1, and down 18% from 249,501 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.This graph shows the REO inventory for Fannie, Freddie and the FHA.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. Most analysts expect an increase in foreclosures, and the number of REO might increase over the next several quarters.

• BLS: Job Openings increased in June

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings increased in June to 3.762 million, up from 3.657 million in May. The number of job openings (yellow) has generally been trending up, and openings are up about 16% year-over-year compared to June 2011. This is the most job openings since mid-2008.

Quits decreased slightly in June, however quits are up about 9.5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• CoreLogic: House Price Index increases in June, Up 2.5% Year-over-year

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was up 1.3% in May, and is up 2.5% over the last year.

The index is off 29% from the peak - and is up 7% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has turned positive.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.This is the fourth consecutive month with a year-over-year increase, and excluding the tax credit bump, these are the first year-over-year increases since 2006.

“Home prices are responding positively to reductions in both visible and shadow inventory over the past year,” said Mark Fleming, chief economist for CoreLogic. “This trend is a bright spot because the decline in shadow inventory translates to fewer distressed sales, which helps sustain price appreciation.”

• Weekly Initial Unemployment Claims decline to 361,000

The DOL reports:"In the week ending August 4, the advance figure for seasonally adjusted initial claims was 361,000, a decrease of 6,000 from the previous week's revised figure of 367,000. The 4-week moving average was 368,250, an increase of 2,250 from the previous week's revised average of 366,000."

The DOL reports:"In the week ending August 4, the advance figure for seasonally adjusted initial claims was 361,000, a decrease of 6,000 from the previous week's revised figure of 367,000. The 4-week moving average was 368,250, an increase of 2,250 from the previous week's revised average of 366,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 368,250.

This was below the consensus forecast of 367,000 and is near the lowest level for the four week average this year.

• Other Economic Stories ...

• Fed: Some domestic banks "eased lending standards", seeing "stronger demand"

• Housing: Inventory down 23% year-over-year in early August

• The economic impact of a slight increase in house prices

• Trulia: Asking House Prices increased in July

• Freddie Mac: Increase in Home Prices contributes to Lower Credit Losses

• Fannie Mae reports $5.1 Billion Net Income, Improvement due to increase in house prices, REO sales prices