by Calculated Risk on 9/12/2012 07:01:00 PM

Wednesday, September 12, 2012

FOMC Projections Preview

There is plenty of discussion about QE3 (will they or won't they), but another key piece of information released tomorrow is the projections of the FOMC participants. In advance of the meeting I thought I'd take a look back at the previous projections from the June meeting.

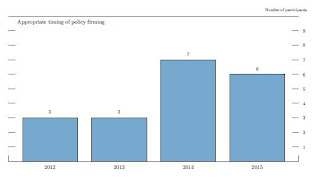

The first chart is when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate.

The key is to see if this shifts further to the right with more participants thinking the first rate increase will happen in 2015 or beyond. Many analysts expect that the FOMC will push out their forward guidance to 2015 (from 2014), and that suggests many more participants will view 2015 or beyond as appropriate.

This graph will probably be extended to 2015, and once again many participants will probably think the Fed Funds rate will be in the current range into 2015.

On the projections, GDP will probably be revised down again for 2012.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

GDP grew at a 1.8% annualized rate in the first half of 2012, and would have to increase at a 2.0% to 3.0% rate in the 2nd half to reach the previous range of projections.

The unemployment rate was at 8.1% in August. This is still in the June projection range, and the key will be to watch the projections for 2013 and 2014. Fed Chairman Ben Bernanke called unemployment a "grave concern" in his recent Jackson Hole speech.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

Overall PCE inflation has been on a 1.3% annualized pace this year through July (although this will probably increase with the increase in oil prices), and core PCE has been increasing at a 1.8% annualized pace. The core PCE rate has slowed further over the last few months. Right now inflation is tracking near the bottom of the previous FOMC projections.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.2 to 1.7 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.7 to 2.0 | 1.6 to 2.0 | 1.6 to 2.0 |

Here was the key sentence from the most recent FOMC minutes: "Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery."

There is nothing in the recent data pointing to a "substantial and sustainable strengthening in the pace of the economic recovery". So I expect QE3 to be announced tomorrow.