by Calculated Risk on 9/10/2012 08:45:00 AM

Monday, September 10, 2012

LPS: Mortgage Delinquencies decreased slightly in July

LPS released their Mortgage Monitor report for July today. According to LPS, 7.03% of mortgages were delinquent in July, down from 7.14% in June, and down from 7.80% in July 2011.

LPS reports that 4.08% of mortgages were in the foreclosure process, down slightly from 4.09% in June, and down slightly from 4.11% in July 2011.

This gives a total of 11.12% delinquent or in foreclosure. It breaks down as:

• 1,960,000 loans less than 90 days delinquent.

• 1,560,000 loans 90+ days delinquent.

• 2,042,000 loans in foreclosure process.

For a total of 5,562,000 loans delinquent or in foreclosure in July. This is down from 5,663,000 last month.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

The total delinquency rate has fallen to 7.03% from the peak in July 2010 of 10.57%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.08%. There are still a large number of loans in this category (about 1.96 million).

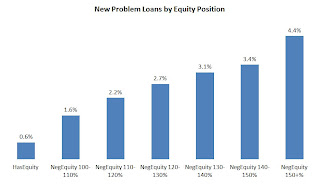

The second graph shows new problem loans by equity position.

The second graph shows new problem loans by equity position.

From LPS:

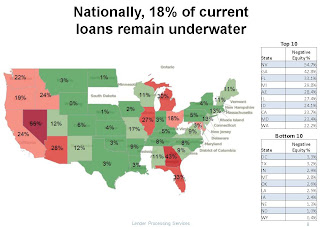

“The July mortgage performance data shows a continuing correlation between negative equity and new problem loans,” explained Herb Blecher, senior vice president, LPS Applied Analytics.The third graph shows percent negative equity by state.

From Herb Blecher:

From Herb Blecher: “Nationally, 18 percent of borrowers who are current on their loan payments are ‘underwater’ (owing more on the mortgage than the home’s current market value), ranging from a low of 0.4 percent in Wyoming to nearly 55 percent in Nevada. As negative equity increases, we see corresponding increases in the number of new problem loans. In Nevada and Florida, two of the states with the highest percentage of underwater borrowers, more than three percent of borrowers who were up to date on their payments are 60 or more days delinquent six months later. This suggests that further home price declines – should they occur – could jeopardize recent improvements.”