by Calculated Risk on 10/30/2012 09:00:00 AM

Tuesday, October 30, 2012

Case-Shiller: House Prices increased 2.0% year-over-year in August

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of June, July and August).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continued to Rise in August 2012 According to the S&P/Case-Shiller Home Price Indices

Data through August 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed average home prices increased by 0.9% for both the 10- and 20-City Composites in August versus July 2012. Nineteen of the 20 cities and both Composites posted positive monthly gains in August; Seattle was the only exception where prices declined 0.1% over the month.

The 10- and 20-City Composites recorded annual returns of +1.3% and +2.0% in August 2012 – an improvement over the +0.6% and +1.2% respective annual rates posted for July 2012. Eighteen of the 20 cities and both Composites posted better annual returns in August compared to July 2012. Annual returns for Dallas remained unchanged at +3.6% and Chicago saw its annual return worsen from -1.0% in July to 1.6% in August 2012.

...

“Home prices continued climbing across the country in August,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Nineteen of the 20 cities and both Composites showed monthly gains in August. Seventeen cities and both Composites posted positive annual returns in August 2012. In 18 cities and both Composites annual rates improved in August versus July. Dallas’ rate remained unchanged at +3.6% and Chicago worsened slightly from a -1.0% annual rate in July to a -1.6% annual rate in August.

“Phoenix continues to lead the home price recovery. It recorded its fourth consecutive month of double-digit positive annual returns with a +18.8% rate for August. Atlanta posted a -6.1% annual rate, however this is significantly better than the nine consecutive months of double-digit declines it posted from October 2011 through June 2012. Las Vegas’ annual rate finally moved to positive territory with a +0.9% annual rate of change in August 2012, its first since January 2007.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.5% from the peak, and up 0.4% in August (SA). The Composite 10 is up 4.0% from the post bubble low set in March (SA).

The Composite 20 index is off 30.92% from the peak, and up 0.5% (SA) in August. The Composite 20 is up 4.4% from the post-bubble low set in March (SA).

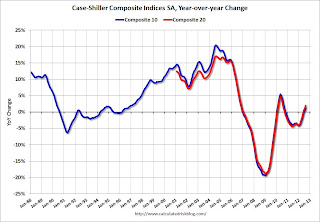

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 1.3% compared to August 2011.

The Composite 20 SA is up 2.0% compared to August 2011. This was the third consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in August seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 59.5% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through August 2012) is above previous declines for all cities.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in August seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 59.5% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through August 2012) is above previous declines for all cities.This was about at the consensus forecast and the recent change to a year-over-year increase is a significant story. I'll have more on prices later.