by Calculated Risk on 10/20/2012 01:10:00 PM

Saturday, October 20, 2012

Schedule for Week of Oct 21st

Earlier:

• Summary for Week Ending Oct 19th

The key U.S. economic report for the coming week is the Q3 advance GDP report to be released on Friday. Also New Home sales will be released on Wednesday.

For manufacturing, two regional manufacturing reports will be released (Richmond and Kansas City Fed surveys).

There is an FOMC meeting on Tuesday and Wednesday, with an announcement scheduled for Wednesday at 2:15 PM ET. No significant announcement is expected.

Expected: LPS "First Look" Mortgage Delinquency Survey for September.

9:00 PM: Third Presidential Debate: President Obama and former Governor Romney debate Foreign policy at Lynn University in Boca Raton, Florida.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October. The consensus is for an increase to 6 for this survey from 4 in September (above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for October. The consensus is for a reading of 51.5, unchanged from September.

10:00 AM ET: New Home Sales for September from the Census Bureau.

10:00 AM ET: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for an increase in sales to 385 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 373 thousand in August. Watch for possible upgrades to the sales rates for previous months.

10:00 AM: FHFA House Price Index for August 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.4% increase in house prices.

2:15 PM: FOMC Meeting Announcement. No significant announcement is expected.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 372 thousand from 388 thousand.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 7.0% decrease in durable goods orders.

8:30 AM ET: Chicago Fed National Activity Index (September). This is a composite index of other data.

10:00 AM ET: Pending Home Sales Index for September. The consensus is for a 2.5% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for October. The consensus is for an a reading of 4, up from 2 in September (above zero is expansion).

8:30 AM: Q3 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.9% annualized in Q3.

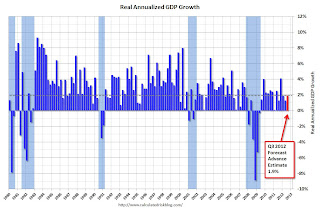

8:30 AM: Q3 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.9% annualized in Q3.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q3 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for no change from the preliminary reading of 83.1.