by Calculated Risk on 10/06/2012 01:01:00 PM

Saturday, October 06, 2012

Schedule for Week of Oct 7th

Earlier:

• Summary for Week Ending Oct 5th

Early in the week, the focus will be on Europe with a report due on Greece, the ESM becoming active, and a finance minister meeting.

The key US report for this week will be the August trade balance report on Thursday.

Note: I will be in San Francisco later this week attending the Zillow / USC housing forum.

6:00 AM ET: Europe's European Stability Mechanism (ESM) will become active.

6:00 AM: The "Troika" Report On Greece will be released.

12:00 PM: the EU Finance Minsters meet in Luxembourg.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.4% increase in inventories.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

8:30 AM: Trade Balance report for August from the Census Bureau.

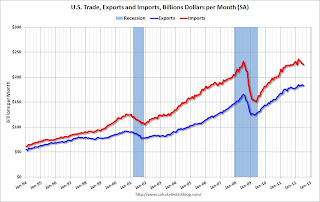

8:30 AM: Trade Balance report for August from the Census Bureau. This graph is through July. Both exports and imports decreased in July. Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

The consensus is for the U.S. trade deficit to increase to $44.0 billion in August, up from from $42.0 billion in July. Export activity to Europe will be closely watched due to economic weakness.

8:30 AM: Import and Export Prices for September. The consensus is a for a 0.7% increase in import prices

10:00 AM: Speech by Fed Governor Jeremy Stein, "Evaluating Large-Scale Asset Purchases", At the Brookings Institution Discussion, Washington, D.C.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for sentiment to be unchanged at 78.3.