by Calculated Risk on 10/13/2012 08:01:00 AM

Saturday, October 13, 2012

Summary for Week Ending Oct 12th

This was a very light week for US economic data. Don't worry, there will be plenty of data next week!

Weekly initial unemployment claims dropped sharply, but a DOL official said the decline was mostly related to one state not reporting quarterly claims - so we might see a large upward revision next week.

From Kathleen Pender at the San Francisco Chronicle: California EDD denies it under-reported jobless claims

[A] DOL spokesman, who spoke on condition of anonymity ... said the department was expecting an 18.5 percent increase in new claims last week; instead it reported only an 8.6 percent increase. (These numbers are not seasonally adjusted; the seasonally adjusted jobless claims fell by 30,000 from the week before).Consumer sentiment was at the highest level since 2007 - still weak, but improving. The trade deficit is increased in August, and shows an ongoing structural imbalance.

Unadjusted claims often shoot up the first week of a new quarter ... state employment departments have to review certain unemployment recipients to make sure they are not collecting benefits when they have a job. They also have to check up on some people who are receiving federal extended benefits, which start after a person has exhausted their regular state benefits. Sometimes, people who are getting extended benefits and get a part-time job or freelance work have to start over with a new state claim. As part of their quarterly review, the states are supposed to weed these people out and put them on a new state claim, which for statistical purposes counts as a new jobless claim.

States normally do this at the end of a quarter, which contributes to a jump in new claims at the beginning of the next quarter. The labor department spokesman said, “One large state has not completed this process,” which is why the data reported [this week] was better than expected.

He would not name the state but said it would be clear when the department issues a state-by-state breakdown of this week’s report next week. EDD spokeswoman Loree Levy could not tell me whether California is the state that had not yet finished this task. “We have been completing this on a timely basis for years,” she said.

Here is a summary of last week in graphs:

• Trade Deficit increased in August to $44.2 Billion

The Department of Commerce reported:

The Department of Commerce reported: [T]otal August exports of $181.3 billion and imports of $225.5 billion resulted in a goods and services deficit of $44.2 billion, up from $42.5 billion in July, revised. August exports were $1.9 billion less than July exports of $183.2 billion. August imports were $0.2 billion less than July imports of $225.7 billion.July was revised from $42.0 billion. The trade deficit was larger than the consensus forecast of $44.0 billion.

Oil averaged $94.36 in August, up slightly from $93.83 per barrel in July. Import oil prices will probably increase further in September. The trade deficit with China decreased slightly to $28.7 billion in August, down from $29.0 billion in August 2011. Still, most of the trade deficit is due to oil and China.

The trade deficit with the euro area was $9.7 billion in August, up from $7.8 billion in August 2011.

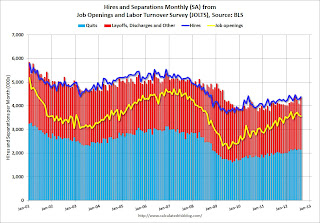

• BLS: Job Openings "essentially unchanged" in August, Up year-over-year

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011.

Jobs openings decreased in August to 3.561 million, down slightly from 3.593 million in July. The number of job openings (yellow) has generally been trending up, and openings are up about 13% year-over-year compared to August 2011. Quits decreased slightly in August, and quits are up about 5% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

This suggests a gradually improving labor market.

• Weekly Initial Unemployment Claims declined sharply to 339,000

The DOL reports:

The DOL reports:In the week ending October 6, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 30,000 from the previous week's revised figure of 369,000. The 4-week moving average was 364,000, a decrease of 11,500 from the previous week's revised average of 375,500.The previous week was revised up from 367,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined sharply to 364,000. This is just above the cycle low for the 4-week average of 363,000 in March.

• Consumer Sentiment increased to 83.1, Highest since 2007

The preliminary Reuters / University of Michigan consumer sentiment index for October increased to 83.1, up from the September reading of 78.3.

This is still fairly weak, but this is the highest level since 2007.