by Calculated Risk on 11/17/2012 05:01:00 AM

Saturday, November 17, 2012

Summary for Week Ending Nov 16th

Hurricane Sandy impacted the economic data released last week, especially retail sales, industrial production and initial weekly unemployment claims. The Fed reported that Sandy "reduced the rate of change in total output by nearly 1 percentage point". Also the Philly Fed and Empire State manufacturing surveys were weak due to Sandy. Since we are usually looking for the trend in the data, we have to be careful to look through short term event driven increases or decreases in the data. Overall I'd expect the data to return to trend fairly quickly.

Most of the discussion last week was related to the "fiscal slope", or more accurately, how much austerity the US should enact in 2013. This will be an ongoing discussion, and I expect some reasonable compromise to be reached - although I expect taxes will increase on just about everyone in 2013 with a combination of the payroll tax cut expiring and tax rates for higher income earners increasing.

Fed Chairman Ben Bernanke spoke this week and expressed concern that mortgage lending standards might be "overly tight". Also the FOMC minutes suggested the Fed is considering setting unemployment rate and inflation thresholds for raising the Fed Funds rate. I'll have more on thresholds before the FOMC meeting in December.

There was some good news on mortgage delinquencies. The MBA reported that delinquencies declined again in Q3, although they believe there is several years of "in foreclosure" inventory that still needs to be resolved.

Here is a summary of last week in graphs:

• Retail Sales declined 0.3% in October

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales declined 0.3% from September to October (seasonally adjusted), and sales were up 3.8% from October 2011. Sales for September were revised up to a 1.3% increase (from 1.1% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

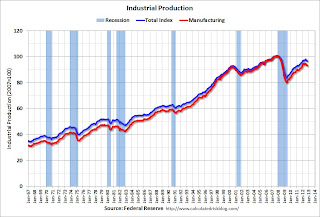

• Industrial Production decreased 0.4% in October due to Hurricane Sandy, Capacity Utilization decreased

The Fed reported: "Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point."

The Fed reported: "Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point."

This graph shows Capacity Utilization. This series is up 10.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production decreased in October to 96.6. This is 15% above the recession low, but still 4.1% below the pre-recession peak.

IP was slightly below expectations due to the impact of Hurricane Sandy. We will probably see some bounce back over the next couple of months.

• Weekly Initial Unemployment Claims increased sharply to 439,000

The DOL reported: "In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000."

The DOL reported: "In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

• Key Measures show low inflation in October

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.On a monthly basis, two of these measure were above the Fed's target; median CPI was at 2.3% annualized, core CPI increased 2.2% annualized. However trimmed-mean CPI was at 1.7% annualized, and core PCE for September increased 1.4% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis.

• MBA: Mortgage Delinquencies decreased in Q3

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.From the MBA: Mortgage Delinquency and Foreclosure Rates Decreased During Third Quarter

This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.