by Calculated Risk on 11/15/2012 12:01:00 AM

Thursday, November 15, 2012

Zillow: 1.3 million fewer U.S. homeowners were in negative equity in Q3

From Zillow: Negative Equity Recedes in Third Quarter; Fewer than 30% of Homeowners with Mortgages Now Underwater

Negative equity fell in the third quarter, with 28.2 percent of all homeowners with mortgages underwater, down from 30.9 percent in the second quarter, according to the third quarter Zillow® Negative Equity Report. ...According to Zillow, 1.7 homeowners have moved out of negative equity over the least two quarters.

Slightly more than 14 million U.S. homeowners with a mortgage were in negative equity, or underwater, in the quarter, owing more on their mortgages than their homes are worth. That was down from 15.3 million in the second quarter.

Much of the decline in negative equity can be attributed to U.S. home values rising 1.3 percent in the third quarter compared to the second quarter ...

“The fall in negative equity rates means homeowners have additional options for refinancing or selling their homes,” said Zillow Chief Economist Dr. Stan Humphries. “But while we’re moving in the right direction, a substantial number of homes are still locked up in negative equity, unable to enter the existing re-sale market despite the desires of their owner. The housing market has found real momentum of its own, but is not immune from shocks to the broader economy. If negotiations centered on resolving the fiscal cliff don’t inspire confidence in investors and consumers alike, recent home value gains – and, as a result, falling negative equity rates – could stall.”

Click on graph for larger image.

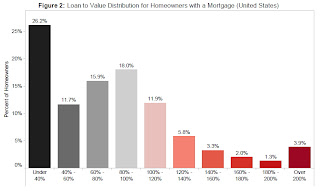

Click on graph for larger image.Zillow provided this chart of Zillow's estimate of the Loan-to-Value (LTV) for homeowners with a mortgage.

The homeowners with a little negative equity are probably at low risk of foreclosure, but at the far right - like the 3.9% who owe more than double what their homes are worth - are clearly at risk.

Here is an interactive map of Zillow's negative equity data.