by Calculated Risk on 11/30/2012 08:25:00 PM

Friday, November 30, 2012

Goldman Sachs: "Moving Over the Hump"

To end the week on a slightly upbeat note, here is a multi-year forecast from Goldman Sachs economists Jan Hatzius and Sven Jari Stehn: The US Economy in 2013-2016: Moving Over the Hump. A couple of excerpts, first on next year:

We expect US economic growth to remain below 2% in the first half of 2013. The step-up in the pace of fiscal retrenchment is likely to outweigh the healing in the private sector and the bounce-back from the disruptions associated with Hurricane Sandy. The risk to our forecast is tilted to the downside; a full fiscal cliff outcome would likely result in renewed recession. ... But ... growth is likely to improve starting in the second half of 2013.And over the next few years:

emphasis added

The key theme of our 2013-2016 economic forecasts is the “great race” between recovery in the private sector and an offsetting contraction in the government sector. ... Beyond 2013, however, we see a pickup to an above-trend growth pace as the fiscal drag abates to ½%-1% of GDP. ... the private sector is likely to deliver an impulse of around 1½ percentage points to real GDP growth in 2014-2015. Even with a continued drag from fiscal policy, this should result in solidly above-trend growth of 3% or a bit more. This would still not be a very rapid recovery by the standards of past cycles, but it would be clearly better than the 2%-2½% seen in the recovery so far.Goldman sees housing starts at a 900 thousand annual rate in the first half of 2013, and around 1 million in the 2nd half of next year They are forecasting new home sales at around a 400 thousand annual rate in the 1st half, and picking up to close to around 500 thousand (annual rate) in Q4. Not mentioned in the note (I was on the conference call earlier), the Goldman forecast for the S&P500 is 1575 by the end of 2013.

Happy Friday to all!

Fannie Mae, Freddie Mac Mortgage Serious Delinquency rates declined in October

by Calculated Risk on 11/30/2012 05:01:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in October to 3.35% from 3.41% September. The serious delinquency rate is down from 4.00% in October last year, and this is the lowest level since March 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 3.31%, from 3.37% in September. Freddie's rate is down from 3.54% in October 2011, and this is the lowest level since August 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates ongoing progress, the "normal" serious delinquency rate is under 1% - and it looks like it will take several years until the rates back to normal.

Restaurant Performance Index indicates contraction in October

by Calculated Risk on 11/30/2012 12:08:00 PM

From the National Restaurant Association: Restaurant Performance Index Fell to its Lowest Level in 14 Months as Operator Optimism Plunged

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.5 in October, down 0.9 percent from September. In addition, October represented the first time in 14 months that the RPI fell below 100, which signifies contraction in the index of key industry indicators.

“Although restaurant operators overall continued to report positive same-store sales in October, their short-term outlook for sales growth and the economy is decidedly more pessimistic,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Nearly two out of five restaurant operators expect business conditions to worsen in the next six months, which is double the proportion that expect conditions to improve.”

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 99.3 in October – down 0.6 percent from a level of 99.9 in September. While same-store sales remained positive in October, declines in the labor and customer traffic indicators outweighed the performance, which resulted in a Current Situation Index reading below 100 for the third time in the last four months.

Click on graph for larger image.

Click on graph for larger image.The index declined to 99.5 in October, down from 100.4 in September (below 100 indicates contraction).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

The impact of Sandy on PCE, Chicago PMI at 50.4

by Calculated Risk on 11/30/2012 10:00:00 AM

I've receive several questions about the impact of Hurricane Sandy on PCE. Sandy hit New York city on October 29th.

We have an example of a hurricane hitting at the end of a month. Katrina hit on August 29, 2005, so we can look back at the real PCE numbers then.

July, 2005: $8,886.8 (Billions of chained (2005) dollars; seasonally adjusted at annual rates)

Aug, 2005: $8,854.9 (Katrina hit on Aug 29th, decline of $32 billion)

Sept, 2005: $8,817.0 (decline of $37 billion)

Then PCE increased in October and November to $8,833.8 and $8,878.4, respectively.

This time for real PCE:

Sept, 2012: $9,641.9

Oct, 2012: $9,612.4 (Sandy hit on Oct 29th, decline of $29 billion)

So Sandy will probably impact November PCE, and any impact on PCE from the storm will be mostly over in December.

From Joe Joe Weisenthal at Business Insider: CHICAGO PMI RISES TO 50.4 — But Huge Drop In New Orders

ChicagoPMI rose back ... 50.4 was a hair shy of estimates.Above 50 is expansion and this follows two months of contraction. Last month the Chicago PMI was at 49.9.

The new orders index fell to 45.3 from 50.6.

On the other hand, employment rose to 55.2 from 50.3.

Personal Income unchanged in October, Spending decreased 0.2%

by Calculated Risk on 11/30/2012 08:47:00 AM

The BEA released the Personal Income and Outlays report for October:

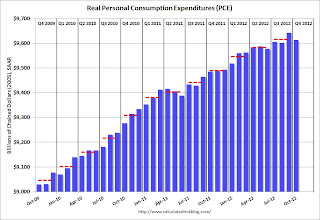

Personal income increased $0.4 billion, or less than 0.1 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $20.2 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

The October estimates of personal income and outlays reflect the effects of Hurricane Sandy, which made landfall in the United States on October 29. The storm affected 24 states, with particularly severe damage in New York and New Jersey. BEA cannot quantify the total impact of the storm on personal income and outlays because most of the source data used to estimate these components reflect the effects of the storm and cannot be separately identified. However, BEA did make adjustments where source data were not yet available or did not reflect the effects of Sandy. The largest of these adjustments was for work interruptions, which reduced wages and salaries by about $18 billion (at an annual rate).

Real PCE -- PCE adjusted to remove price changes -- decreased 0.3 percent in October, in contrast to an increase of 0.4 percent in September. ... The price index for PCE increased 0.1 percent in October, compared with an increase of 0.3 percent in September. The PCE price index, excluding food and energy, increased 0.1 percent in October, the same increase as in September.

...

Personal saving -- DPI less personal outlays -- was $410.1 billion in October, compared with $391.3 billion in September. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.4 percent in October, compared with 3.3 percent in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. According to the BEA, Hurricane Sandy impacted PCE in October, but the BEA could not quantify the total impact - however PCE in October was weak.

A key point is the PCE price index has only increased 1.7% over the last year, and core PCE is up only 1.6%.

Thursday, November 29, 2012

Friday: October Personal Income and Outlays, Chicago PMI

by Calculated Risk on 11/29/2012 09:04:00 PM

A couple of articles on the fiscal slope negotiations:

Suzy Khimm at the WaPo has the initial White House proposal: The White House’s fiscal cliff proposal

Jonathan Weisman at the NY Times writes: G.O.P. Balks at White House Plan on Fiscal Crisis

Treasury Secretary Timothy F. Geithner presented the House speaker, John A. Boehner, a detailed proposal on Thursday to avert the year-end fiscal crisis with $1.6 trillion in tax increases over 10 years, $50 billion in immediate stimulus spending, home mortgage refinancing and a permanent end to Congressional control over statutory borrowing limits.For the economy this proposal would resolve the "fiscal cliff" uncertainty, significant reduce the fiscal drag, and also reduce the deficit. Of course there are other agendas too - this proposal is a starting point - but hopefully eliminating the debt ceiling nonsense is part of the final agreement.

My guess is an agreement will be reached, perhaps in early January after the tax cuts expire, so politicians can claim to be cutting taxes.

Friday:

• At 8:30 AM, the Personal Income and Outlays report for October will be released. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

The last question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Freddie Mac: Mortgage Rates Near Record Lows

by Calculated Risk on 11/29/2012 05:05:00 PM

From Freddie Mac today: Mortgage Rates Virtually Unchanged

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates virtually unchanged and remaining near their record lows ...

30-year fixed-rate mortgage (FRM) averaged 3.32 percent with an average 0.8 point for the week ending November 29, 2012, up from last week when it averaged 3.31 percent. Last year at this time, the 30-year FRM averaged 4.00 percent.

15-year FRM this week averaged 2.64 percent with an average 0.6 point, up from last week when it averaged 2.63 percent. A year ago at this time, the 15-year FRM averaged 3.30 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a significant refinance boom, and refinance activity has picked up.

There has also been an increase in refinance activity due to HARP.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.The y-intercept is around 2.6%, so if the 10 year Treasury yield falls to zero, 30 year mortgage rates would still be around 2.6% (using this fit).

Currently the 10 year Treasury yield is 1.62% and 30 year mortgage rates are at 3.32%.

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).Note: Mortgage rates were at or below 5% back in the 1950s.

A few comments on GDP Revision and Unemployment Claims

by Calculated Risk on 11/29/2012 02:21:00 PM

• GDP Revision: Although Q3 real GDP growth was revised up from 2.0% annualized to 2.7%, the underlying details were disappointing. There were three main sources for the revision: 1) Personal consumption expenditures (PCE) increased at a 1.4% annualized rate, revised down from 2.0%. This means PCE contributed 0.99 percentage points to real growth in Q3 (revised down from a 1.42 percentage point contribution in the advance release), and 2) the change in private inventories added 0.77 percentage point contribution to growth (revised up from -0.12), and 3) exports were revised up to a 0.16 percentage point contribution (revised up from -0.23).

This suggests weaker final demand in the US than originally estimated.

Also Justin Wolfers at Bloomberg discusses the weak Gross Domestic Income (GDI) data: The Bad News in Today's Happy Growth Report. Sluggish growth continues.

• Unemployment Claims: A reader sent me some "analysis" on the initial weekly unemployment claims report released this morning that was incorrect. The writer wrote that the 1) the 4-week moving average was at the highest level this year, 2) that there were 30,603 fewer layoffs in New York "last week", so 3) the recent increase in the 4-week average can't be blamed on Hurricane Sandy.

The first point is correct. The 4-week average is at the highest level since October 2011, but the conclusion about not blaming Sandy is incorrect.

First, the initial claims data is very noisy, so most analysts use the 4-week average to smooth out the noise. When an event happens - like Hurricanes Katrina in 2005 or Sandy this year - the 4-week average lags the event. Here is the unemployment claims data for the last 10 weeks:

| Week Ending | Initial Claims (SA) | 4-Week Average |

|---|---|---|

| 9/22/2012 | 363,000 | 375,000 |

| 9/29/2012 | 369,000 | 375,500 |

| 10/6/2012 | 342,000 | 364,750 |

| 10/13/2012 | 392,000 | 366,500 |

| 10/20/2012 | 372,000 | 368,750 |

| 10/27/2012 | 363,000 | 367,250 |

| 11/3/2012 | 361,000 | 372,000 |

| 11/10/2012 | 451,000 | 386,750 |

| 11/17/2012 | 416,000 | 397,750 |

| 11/24/2012 | 393,000 | 405,250 |

It is no surprise that the 4-week average increased this week. The 363,000 claims for the week ending Oct 27th were dropped out of the average and replaced with the 393,000 initial claims this week - so the 4-week average increased even though initial unemployment claims are declining.

The 4-week average will probably increase again next week as the 361,000 claims for the week ending Nov 3rd will be replaced with the claims for this week. Note: There are some large seasonal adjustment this time of year - especially the week after Thanksgiving - so it is hard to predict the level of claims. But the math is simple.

The good news is in two weeks the 451,000 claims for the week of Nov 10th will be dropped out of the 4-week average.

Key point: the 4-week average is intended to smooth out noise, but it lags events.

The writer's conclusion about 30,603 fewer layoffs in New York "last week" so the increase in the 4-week average can't be blamed on hurricane Sandy are incorrect. As part of the weekly release, the DOL notes the UNADJUSTED state data for the PREVIOUS week. The headline number was for the week ending Nov 24th, but the unadjusted state data was for Nov 17th.

The state data for New York showed a large decline, but the week before the New York data showed an even large increase. Since this data is unadjusted, we can't tell if claims are still elevated in New York, but since the increase for the week ending Nov 10th was much larger than the decrease for the week ending Nov 17th, my guess would be that claims are still above normal.

The bottom line is the recent increase in unemployment claims is most likely due to Hurricane Sandy, and there is nothing in the data that would suggest otherwise. And using simple arithmetic, we'd expect the 4-week average to lag the event. The state data supports this view, and I expect the 4-week average to increase again next week, and then start declining the following week (although there can be large seasonal effects this time of year, so we could be off a week or two).

Kansas City Fed: Regional Manufacturing Activity "Eased Further" in November

by Calculated Risk on 11/29/2012 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Eased Further

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity eased further in November, while producers’ expectations were unchanged from last month at modestly positive levels.Most of the regional manufacturing surveys were weak in November (Richmond was the exception).

“We saw a decline in regional factory activity for the second straight month, and firms have put hiring plans on hold for the next six months” said Wilkerson. “However, overall production and capital spending are expected to rise moderately in coming months.”

...

Several contacts noted uncertainties about the upcoming fiscal cliff, and a few producers cited delayed deliveries and reduced orders from the East Coast as a result of the Hurricane Sandy. Price indexes moderated slightly.

The month-over-month composite index was -6 in November, down from -4 in October and 2 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. This marked the first time the composite index has been negative for two straight months since mid-2009. Manufacturing slowed at durable goods-producing plants, while nondurable factories reported a slight uptick in activity, particularly for food and plastics products. Other month-over-month indexes were mixed in November. The production index was unchanged at -6, while the new orders and order backlog indexes declined for the third straight month to their lowest levels in three years. In contrast, the employment index increased from -6 to 0, and the shipments and new orders for exports indexes were less negative.

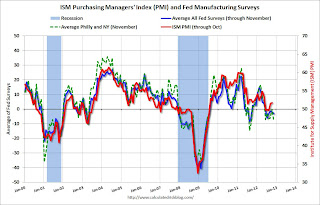

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Monday, Dec 3rd, and these surveys suggest another weak reading.

NAR: Pending Home Sales Index increases in October

by Calculated Risk on 11/29/2012 10:16:00 AM

From the NAR: Pending Home Sales Rise in October to Highest Level in Over Five Years

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 5.2 percent to 104.8 in October from an upwardly revised 99.6 in September and is 13.2 percent above October 2011 when it was 92.6. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December. However, because of the increase in short sales that take longer to close, some of these contract signings are probably for next year.

...

Outside of a few spikes during the tax credit period, pending home sales are at the highest level since March 2007 when the index also reached 104.8. On a year-over-year basis, pending home sales have risen for 18 consecutive months.

Weekly Initial Unemployment Claims decline to 393,000

by Calculated Risk on 11/29/2012 08:30:00 AM

Note: From MarketWatch: U.S. Q3 GDP revised up to 2.7% from 2.0% (I'll have more later on the GDP revision).

The DOL reports:

In the week ending November 24, the advance figure for seasonally adjusted initial claims was 393,000, a decrease of 23,000 from the previous week's revised figure of 416,000. The 4-week moving average was 405,250, an increase of 7,500 from the previous week's revised average of 397,750.The previous week was revised up from 410,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 405,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas (update: claims increased in NY, NJ and other impacted areas over the 4-week period - some of those areas saw a decline this week). Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

Wednesday, November 28, 2012

Thursday: Q3 GDP, Unemployment claims, Pending Home Sales

by Calculated Risk on 11/28/2012 08:55:00 PM

First, Jon Hilsenrath at the WSJ discusses some of the issues that will be discussed at the next FOMC meeting in December: Fed Likely to Keep Buying Bonds

Central bank officials face critical decisions at their next policy meeting Dec. 11-12. ... Since September the Fed has been buying $40 billion a month of mortgage-backed securities and looks set to continue that program. ...My guess is the Fed will expand "QE3" to around $85 billion per month when Operation Twist concludes. On communication, I'm not sure they are ready to change to thresholds for unemployment and inflation, so that will probably wait until March (but it could happen in December).

The more urgent issue is what to do with a $45 billion-a-month program known as Operation Twist, in which the central bank is buying long-term Treasury securities and funding the purchases with sales of short-term Treasurys.

...

Another issue for officials to consider at the December meeting is whether to alter their communications strategy. For several months, they have been debating whether to state explicitly what unemployment rates or inflation rates would get them to raise short-term interest rates from their very low levels. ... If the Fed is going to adopt such a move, it would make sense to do it either at the December meeting or in March, when Mr. Bernanke will hold news conferences and be able to explain the central bank's thinking on the complicated subject.

emphasis added

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

• Also at 8:30 AM, the second estimate for Q3 GDP will be released. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

• At 10:00 AM, the NAR will release Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for November. This is the last of the regional surveys for November, and the consensus is for a reading of -1, up from -4 in October (below zero is contraction).

Earlier on New Home Sales:

• New Home Sales at 368,000 SAAR in October

• New Home Sales and Distressing Gap

• New Home Sales graphs

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

FHFA: HARP Refinance Boom Continued in September

by Calculated Risk on 11/28/2012 04:38:00 PM

Note: HARP is the program that allows borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac - and with high loan-to-value (LTV) ratios - to refinance at low rates. Fannie or Freddie are already responsible for the loan, and allowing the borrower to refinance lowers the default risk.

From the FHFA:

The Federal Housing Finance Agency (FHFA) today released its September Refinance Report, which shows that Fannie Mae and Freddie Mac loans refinanced through the Home Affordable Refinance Program (HARP) accounted for nearly one-quarter of all refinances in the third quarter of 2012. More than 90,000 homeowners refinanced their mortgage in September through HARP with more than 709,000 loans refinanced since the beginning of this year. The continued high volume of HARP refinances is attributed to record-low mortgage rates and program enhancements announced last year.Note: the automated system wasn't released until the end of March - and there were some issues with that system - so HARP refinances didn't really pickup until sometime in Q2. Now they are on pace for around 1 million refinances this year.

...

In September, half of the loans refinanced through HARP had loan-to-value (LTV) ratios greater than 105 percent and one-fourth had LTVs greater than 125 percent.

In September, 19 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which help build equity faster than traditional 30-year mortgages.

HARP refinances in September represented 45 percent of total refinances in states hard hit by the housing downturn–Nevada, Arizona, Florida and Georgia–compared with 21 percent of total refinances nationwide.

These "underwater" borrowers are current (most took out loans 5 to 7 years ago), and they will probably stay current with the lower interest rate.

This table shows the number of HARP refinances by LTV through September of this year compared to all of 2011. Clearly there has been a sharp increase in activity. Note: Here is the September report.

| HARP Activity | |||

|---|---|---|---|

| 2012, Through September | All of 2011 | Since Inception | |

| Total HARP | 709,006 | 400,024 | 1,730,857 |

| LTV >80% to 105% | 407,330 | 340,033 | 1,338,565 |

| LTV >105% to 125% | 159,980 | 59,991 | 250,596 |

| LTV >125% | 141,696 | 0 | 141,696 |

Fed's Beige Book: "Economic activity expanded at a measured pace"

by Calculated Risk on 11/28/2012 02:00:00 PM

Economic activity expanded at a measured pace in recent weeks, according to reports from contacts in the twelve Federal Reserve Districts. Cleveland, Richmond, Atlanta, Chicago, Kansas City, Dallas, and San Francisco grew at a modest pace, while St. Louis and Minneapolis indicated a somewhat stronger increase in activity. In contrast, Boston reported a slower rate of growth. Weaker conditions in New York were attributed to widespread disruptions at the end of October and into November caused by Hurricane Sandy. Philadelphia reported general weakness that was exacerbated by the hurricane. ...And on real estate:

Among key sectors, consumer spending grew at a moderate pace in most Districts, while manufacturing weakened, on balance. Seven of the twelve Districts reported either slowing or outright contraction in manufacturing, and two others gave mixed reports. ...

Overall, markets for single-family homes continued to improve across most Districts with the exception of Boston and Philadelphia. Residential real estate markets in the New York District were mixed but generally firm prior to the storm. Selling prices were steady or rising. Boston, New York, Richmond, Atlanta, Kansas City, and Dallas noted declining or tight inventories.Hmmm ... from "moderate" growth a few months ago, to "modest" growth in the last report, and now "measured". I'm not sure about the difference, but it does suggest sluggish growth. Real estate continues to be the bright spot.

Construction and commercial real estate activity generally improved across Districts since the last report. Gains, albeit modest in most cases, were reported by Philadelphia, Richmond, Chicago, and Minneapolis. The gains among Cleveland's contacts were tempered by reports in recent weeks of a slowdown in inquiries and a decline in public-sector projects. Kansas City described activity as holding firm and noted that real estate markets remained stronger than a year ago.

New Home Sales and Distressing Gap

by Calculated Risk on 11/28/2012 11:49:00 AM

New home sales in October were below expectations at a 368 thousand seasonally adjusted annual rate (SAAR). And sales for September were revised down from 389 thousand SAAR to 369 thousand.

This has led to some worrying about the housing recovery, as an example from Reuters: New Home Sales Drop 0.3%, Cast Shadow on Recovery

The data leaves the pace of new home sales just below the pace reported in May, suggesting little upward momentum the market for new homes.Yes, new home sales have been moving sideways for the last 6 months. However sales are still up significantly from 2011, and I expect sales to continue to increase over the next few years.

New home sales have averaged 361,000 on an annual rate basis through October. That means sales are on pace to increase 18% from last year. Most sectors would be pretty upbeat about an 18% increase in sales.

But even with the significant increase this year, 2012 will be the 3rd lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, but below the 375,000 sales in 2009. I expect sales to double from here within the next several years as distressed sales continue to decline.

Click on graph for larger image.

Click on graph for larger image.I started posting this graph four years ago when the "distressing gap" first appeared.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through October. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 368,000 SAAR in October

• New Home Sales graphs

New Home Sales at 368,000 SAAR in October

by Calculated Risk on 11/28/2012 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 368 thousand. This was down from a revised 369 thousand SAAR in August (revised down from 389 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in October 2012 were at a seasonally adjusted annual rate of 368,000 ... This is 0.3 percent below the revised September rate of 369,000, but is 17.2 percent above the October 2011 estimate of 314,000.

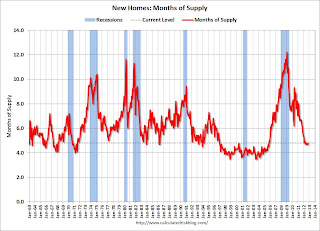

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply increased in October to 4.8 months. September was revised up to 4.7 months (from 4.5 months).

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of October was 147,000. This represents a supply of 4.8 months at the current sales rate.On inventory, according to the Census Bureau:

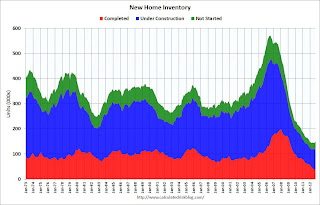

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was just above the record low in October. The combined total of completed and under construction is also just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In October 2012 (red column), 29 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in October. This was the third weakest October since this data has been tracked (above 2011 and 2010). The high for October was 105 thousand in 2005.

New home sales have averaged 361 thousand SAAR over the first 10 months of 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.

New home sales have averaged 361 thousand SAAR over the first 10 months of 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.This was below expectations of 387,000. I'll have more soon ...

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

by Calculated Risk on 11/28/2012 07:03:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

This week’s results include an adjustment for the Thanksgiving holiday. ...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.53 percent from 3.54 percent, with points remaining constant at 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 8 of the last 10 weeks and is now near the high for the year.

Tuesday, November 27, 2012

Wednesday: New Home Sales, Beige Book

by Calculated Risk on 11/27/2012 09:01:00 PM

Earlier, a little good manufacturing news from the Richmond Fed: Manufacturing Activity Advanced in November; Optimism Increased

Manufacturing activity in the central Atlantic region advanced moderately in November following a slight pullback in October, according to the Richmond Fed's latest survey. ...And on consumer confidence from the Financial Times: US growth hopes lifted by housing data

In November, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained sixteen points to 9 from October's reading of −7. Among the index's components, shipments rose twenty points to 11, new orders moved up seventeen points to finish at 11, and the jobs index increased eight points to 3.

The figures suggest that consumers and companies are holding their nerve despite anxiety about the fiscal cliff ... The Conference Board, an industry group, said its index of consumer attitudes towards the economy rose to 73.7 in November, its highest since February 2008.Wednesday:

excerpt with permission

• At 7:00 AM, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for October from the Census Bureau will be released. The consensus is for a decrease in sales to 387 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 389 thousand in September.).

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 3.0% year-over-year in September

• Case-Shiller House Price Comments and Graphs

• Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: The Recession Probability Chart

by Calculated Risk on 11/27/2012 05:36:00 PM

A few weeks ago, I mentioned a recession probability chart from the St Louis Fed that was making the rounds. (see below). This graph shouldn't be interpreted as indicating a new recession. Jeff Miller at a Dash of Insight discussed why: Debunking the 100% Recession Chart.

Now the author, University of Oregon Professor Jeremy Piger, posted some FAQs and data for the chart online. Professor Piger writes:

2. How should I interpret these probabilities as a recession signal?

Historically, three consecutive months of smoothed probabilities above 80% has been a reliable signal of the start of a new recession, while three consecutive months of smoothed probabilities below 20% has been a reliable signal of the start of a new expansion. For an analysis of the performance of the model for identifying new turning points in real time, see:

Chauvet, M. and J. Piger, “A Comparison of the Real-Time Performance of Business Cycle Dating Methods,” Journal of Business and Economic Statistics, 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is the chart from FRED at the St Louis Fed.

Obviously we haven't seen three consecutive months above 80%. Also I expect the recent data point to be revised down.

This is kind of a Woody Allen and Marshall McLuhan moment! Those arguing this chart indicated a 100% probability of a new recession knew nothing of Piger's work.

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 3.0% year-over-year in September

• Case-Shiller House Price Comments and Graphs

• Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

Fed: Consumer Deleveraging Continued in Q3, Student Debt increases

by Calculated Risk on 11/27/2012 03:00:00 PM

From the NY Fed: Decrease in Overall Debt Balance Continues Despite Rise in Non-Real Estate Debt

In its latest Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York announced that in the third quarter, non-real estate household debt jumped 2.3% to $2.7 trillion. The increase was due to a boost in student loans ($42 billion), auto loans ($18 billion) and credit card balances ($2 billion).Here is the Q3 report: Quarterly Report on Household Debt and Credit

During the third quarter of 2012, total consumer indebtedness shrunk $74 billion to $11.31 trillion, a 0.7% decrease from the previous quarter. The reduction in overall debt is attributed to a decrease in mortgage debt ($120 billion) and home equity lines of credit ($16 billion), despite mortgage originations increasing for a fourth consecutive quarter.

“The increase in mortgage originations, auto loans and credit card balances suggests that consumers are slowly gaining confidence in their financial position,” said Donghoon Lee, senior economist at the New York Fed. “As consumers feel more comfortable, they may start to make purchases that were previously delayed.”

emphasis added

Mortgages, the largest component of household debt, continue to drive the decline in overall indebtedness. Mortgage balances shown on consumer credit reports continued to drop, and now stand at $8.03 trillion, a 1.5% decrease from the level in 2012Q2. Home equity lines of credit (HELOC) balances dropped by $16 billion (2.7%). Non-mortgage household debt balances instead jumped by 2.3% in the third quarter to $2.7 trillion, boosted by increases of $18 billion in auto loans, $42 billion in student loans, and $2 billion in credit card balances.Here are two graphs:

...

About 242,000 individuals had a new foreclosure notation added to their credit reports between June 30 and September 30, a slowdown of 5.5%, continuing the downward trend as foreclosure starts slowly move toward their pre-crisis levels.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased in Q3. This was mostly due to a decline in mortgage debt.

However student debt is still increasing. From the NY Fed:

Outstanding student loan balances increased to $956 billion as of September 30, 2012, an increase of $42 billion from the previous quarter. However, of the $42 billion, $23 billion is new debt while the remaining $19 billion is attributed to previously defaulted student loans that have been newly updated on credit reports this quarter.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Overall, delinquency rates improved slightly in 2012Q3. As of September 30, 8.9% of outstanding debt was in some stage of delinquency, compared with 9.0% in 2012Q2. About $1.01 trillion of debt is delinquent, with $740 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 11/27/2012 12:11:00 PM

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

For the Case-Shiller National index, real prices declined slightly in Q3, and are up 1.7% year-over-year. The nominal Case-Shiller National index is up 3.6% year-over-year.

Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through September) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to August 2003 levels, and the CoreLogic index (NSA) is back to December 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to July 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to 1999 or early 2000 levels.

I think nominal house prices have bottomed, but I expect real prices to mostly move sideways for the next year or two.

Case-Shiller House Price Comments and Graphs

by Calculated Risk on 11/27/2012 09:59:00 AM

Case-Shiller reported the fourth consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in September suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month this year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.5% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 3.0% |

| Oct-12 | |

| Nov-12 | |

| Dec-12 | |

| Jan-13 | |

On a not seasonally adjusted basis (NSA), Case-Shiller house prices will probably start to decline month-to-month in October. But I think prices will remain above the post-bubble lows set earlier this year.

Note: S&P reports the NSA, the following graphs use the Seasonally Adjusted (SA) data.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.4% from the peak, and up 0.3% in September (SA). The Composite 10 is up 4.2% from the post bubble low set in January 2012 (SA).

The Composite 20 index is off 30.7% from the peak, and up 0.4% (SA) in September. The Composite 20 is up 4.7% from the post-bubble low set in January 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 2.1% compared to September 2011.

The Composite 20 SA is up 3.0% compared to September 2011. This was the fourth consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in September seasonally adjusted (15 of 20 cities increased NSA). Prices in Las Vegas are off 59.1% from the peak, and prices in Dallas only off 4.8% from the peak. Note that the red column (cumulative decline through September 2012) is above previous declines for all cities.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in September seasonally adjusted (15 of 20 cities increased NSA). Prices in Las Vegas are off 59.1% from the peak, and prices in Dallas only off 4.8% from the peak. Note that the red column (cumulative decline through September 2012) is above previous declines for all cities.I'll have more on house prices later.

Case-Shiller: Comp 20 House Prices increased 3.0% year-over-year in September

by Calculated Risk on 11/27/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September (a 3 month average of July, August and September).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities), and the quarterly National Index.

From S&P: Home Prices Rise for the Sixth Straight Month According to the S&P/Case-Shiller Home Price Indices

Data through September 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... showed that home prices continued to rise in the third quarter of 2012. The national composite was up 3.6% in the third quarter of 2012 versus the third quarter of 2011, and was up 2.2% versus the second quarter of 2012. In September 2012, the 10- and 20-City Composites showed annual returns of +2.1% and +3.0%. Average home prices in the 10- and 20-City Composites were each up by 0.3% in September versus August 2012. Seventeen of the 20 MSAs and both Composites posted better annual returns in September versus August 2012; Detroit and Washington D.C. recorded a slight deceleration in their annual rates, and New York saw no change.This was about at the consensus forecast and the recent change to a year-over-year increase is a significant story. I'll have graphs and more on prices later (S&P's website is having a problem).

“Home prices rose in the third quarter, marking the sixth consecutive month of increasing prices,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “In September’s report all three headline composites and 17 of the 20 cities gained over their levels of a year ago. Month-over-month, 13 cities and both Composites posted positive monthly gains.

“The National Composite increased by 3.6% from the same quarter in 2011 and by 2.2% from the second quarter of 2012. The 10- and 20-City Composites have posted positive annual returns for four consecutive months with a +2.1% and +3.0% annual change in September, respectively. Month-over-month, both Composites have recorded increases for six consecutive months, with the most recent monthly gain being +0.3% for each Composite.

“We are entering the seasonally weak part of the year. The headline figures, which are not seasonally adjusted, showed five cities with lower prices in September versus only one in August; in the seasonally adjusted data the pattern was reversed: one city fell in September versus two in August. Despite the seasons, housing continues to improve.

Monday, November 26, 2012

Tuesday: Case-Shiller House Prices, Durable Goods Orders

by Calculated Risk on 11/26/2012 09:01:00 PM

First, on Greece, here is the Eurogroup statement on Greece. Excerpt:

The Eurogroup was informed that Greece is considering certain debt reduction measures in the near future, which may involve public debt tender purchases of the various categories of sovereign obligations. If this is the route chosen, any tender or exchange prices are expected to be no higher than those at the close on Friday, 23 November 2012.This buy-back lacks details such as the source of money for the buy-backs and how much debt will be bought. The IMF will wait to disburse funds until the results of the buy-backs are known (that was my understanding from the press conference).

From the WSJ: Greece's Creditors Reach Deal on New Aid

From the NY Times: European Finance Ministers Agree on Greek Bailout Terms

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for September will be released. Although this is the September report, it is really a 3 month average of July, August and September. The consensus is for a 2.9% year-over-year increase in the Composite 20 index (NSA) for September. This release also includes the Q3 Case-Shiller National index.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for November will be released. The consensus is for a decrease to -8 for this survey from -7 in October (below zero is contraction).

• Also at 10:00 AM, the FHFA House Price Index for September 2012 will be released. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.5% increase in house prices.

• Also at 10:00 AM, Conference Board's consumer confidence index for November. The consensus is for an increase to 72.8 from 72.2 last month.

• At 3:00 PM: the New York Fed will release the Q3 Report on Household Debt and Credit.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Greek Debt Deal Reached

by Calculated Risk on 11/26/2012 07:38:00 PM

Press conference here.

From Reuters: Euro zone, IMF reach deal on long-term Greek debt

Euro zone finance ministers and the International Monetary Fund clinched agreement on a new debt target for Greece on Monday in a breakthrough towards releasing an urgently needed tranche of loans to the near-bankrupt economy, officials said.From AlphaVille: A mere three weeks later, a Greek debt deal (?)

After nearly 10 hours of talks at their third meeting on the issue in as many weeks, Greece's international lenders agreed to reduce Greek debt by 40 billion euros, cutting it to 124 percent of gross domestic product by 2020, via a package of steps.

UPDATE: Press release here: Eurogroup statement on Greece.

LPS: House Price Index increased 0.1% in September, Up 3.6% year-over-year

by Calculated Risk on 11/26/2012 07:10:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses September closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.1 Percent for the Month; Up 3.6 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on September 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 22.8% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 54.4% from the peak in Las Vegas, 46% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and barely off in Austin and Houston.

Looking at the year-over-year price change, in May, the LPS HPI was up 0.4% year-over-year, in June the index was up 0.9% year-over-year, 1.8% in July, 2.6% in August, and now 3.6% in September. This is steady improvement on a year-over-year basis. Note: Case-Shiller for September will be released tomorrow morning.

LPS: Mortgage delinquencies decreased in October, Percent in foreclosure process lowest since August 2009

by Calculated Risk on 11/26/2012 04:15:00 PM

LPS released their First Look report for October today. LPS reported that the percent of loans delinquent decreased in October compared to September, and declined about 7% year-over-year. Also the percent of loans in the foreclosure process declined sharply in October and are the lowest level since August 2009.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 7.03% from 7.40% in September (delinquencies increased seasonally in September). Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.61% from 3.87% in September.

The number of delinquent properties, but not in foreclosure, is down about 10% year-over-year (400,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 19% or 412,000 year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is starting to decline fairly quickly.

LPS will release the complete mortgage monitor for October in early December.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Oct 2012 | Sept 2012 | Oct 2011 | |

| Delinquent | 7.03% | 7.40% | 7.58% |

| In Foreclosure | 3.61% | 3.87% | 4.30% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,957,000 | 2,170,000 | 2,219,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,543,000 | 1,530,000 | 1,681,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,800,000 | 1,940,000 | 2,212,000 |

| Total Properties | 5,300,000 | 5,640,000 | 6,111,000 |

Timiraos: "The FHA’s Biggest Loser"

by Calculated Risk on 11/26/2012 12:58:00 PM

A frequent topic on this blog back in 2005, 2006, 2007 and even in 2008 were FHA loans and DAPs (seller financed Down-payment Assistance Programs). With DAPs, the seller "donated" the down payment to a non-profit (for a fee of course), and the non-profit gave the down payment to the buyer. This allowed people to get around the FHA's down payment requirement, and to buy for no money down. For nerdy details, see Tanta's DAP for UberNerds

DAPs were finally banned in 2008 after wrecking havoc on the FHA's finances.

From Nick Timiraos at the WSJ: FHA’s Biggest Loser: No-Money-Down Mortgages

One of the biggest reasons the Federal Housing Administration is facing severe financial woes is a problem agency officials identified and sought to correct years ago.The FHA made many bad loans in fiscal years 2008 and 2009 (from October 2007 through October 2009) when private capital left the mortgage market, and the FHA saw a huge surge in market share. With falling house prices, and low down payment loans, many of these borrowers defaulted.

...

A big chunk of the losses leading to a $16.3 billion shortfall have come from programs that allowed home sellers to fund down payments via nonprofit groups that provided them to buyers as a “gift.” After trying for years, the FHA finally prevailed on Congress to shut down the programs in late 2008, but not before the agency backed billions in risky no-money-down loans as home prices were dropping fast.

...

Seller-funded down-payment assistance loans accounted for just 4% of outstanding loans at the end of September, but they represented 13% of all seriously delinquent mortgages, according to a recently released audit.

The audit said that had the FHA not allowed the programs to go forward, then the mortgage program’s $13.5 billion net worth deficit would have turned to a positive $1.77 billion.

However DAPs also played a significant role in negatively impacting the FHA - and that was obvious in early 2005!

Dallas Fed: Regional Manufacturing Activity "Growth Stalls" in November

by Calculated Risk on 11/26/2012 10:30:00 AM

From the Dallas Fed: Growth Stalls and Company Outlook Worsens

Texas factory activity was little changed in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in at 1.7, indicating output barely increased from October.This was below expectations of a reading of 4.7 for the general business activity index. Later this week two more regional manufacturing surveys will be released (Richmond and Kansas City).

Other survey measures suggested flat manufacturing activity in November. The new orders index came in at 0.4, suggesting that demand was unchanged from October.

...

Perceptions of broader business conditions worsened in November. The general business activity index fell to -2.8, returning to negative territory. The company outlook index moved down to -4.8, registering its first negative reading since April.

Labor market indicators were mixed. The employment index edged up to 6.7 in November, with more than 20 percent of firms reporting hiring compared with 15 percent reporting layoffs. The hours worked index dipped from -5.9 to -7.1.

Chicago Fed: Economic Activity Slower in October

by Calculated Risk on 11/26/2012 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in October

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.56 in October from 0.00 in September. All four broad categories of indicators that make up the index decreased from September, and only two made positive contributions to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased from –0.36 in September to –0.56 in October—its eighth consecutive reading below zero. October’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed, and growth was still below trend in October.

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, November 25, 2012

Sunday Night Futures

by Calculated Risk on 11/25/2012 08:59:00 PM

Monday economic releases:

• At 8:30 AM ET, the Chicago Fed will release their National Activity Index for October. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for November will be released. The consensus is for 4.7 for the general business activity index, up from 1.8 in October.

• Expected: LPS "First Look" Mortgage Delinquency Survey for October.

• Also on Monday, Euro zone finance ministers will discuss the funding situation for Greece.

The Asian markets are mostly green tonight, with the Nikkei up 0.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 6 and DOW futures are down 56.

Oil prices are down with WTI futures at $87.95 per barrel and Brent at $111.23 per barrel.

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. Notes: Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent sharp increase and decrease due to refinery problems. If you add New York, it will show the recent spike (much smaller than in California).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Weekend:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Four more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Greece Update: Eurozone finance ministers meet Monday

by Calculated Risk on 11/25/2012 01:08:00 PM

The eurozone finance ministers are meeting on Monday, and trying to reach an agreement to disburse more funds to Greece.

From the Financial Times: Greece upbeat about signing debt deal

Eurozone finance ministers will make another attempt on Monday ... to settle differences over debt relief measures for Athens and give a green light to disburse up to €44bn of aid.And from Bloomberg: Euro Ministers Take Third Swing at Clearing Greek Payment

The stumbling blocks to a deal, in addition to Berlin’s reluctance to accept drastic interest rate cuts, include opposition by some eurozone members to returning profits from the European Central Bank’s purchases of Greek bonds, and a gloomy assessment of Greece’s growth prospects until 2020 by the IMF.

excerpt with permission

Finance chiefs from the 17-member single currency return to Brussels tomorrow ...I expect an agreement will be reached soon that will buy more time.

Euro-area finance ministers held a conference call yesterday to prepare for the Brussels meeting. A breakthrough hinges on coming up with 10 billion euros ($13 billion) through reductions in interest rates charged by creditors and a debt buyback financed by bailout funding. The gap emerged when the finance chiefs agreed this month to give Greece two more years to meet targets.

Update: Case-Shiller House Prices will probably decline month-to-month Seasonally starting in October

by Calculated Risk on 11/25/2012 10:32:00 AM

This is just a reminder: The Not Seasonally Adjusted (NSA) monthly Case-Shiller house price indexes will show month-to-month declines soon, probably starting with the October report to be released in late December. The CoreLogic index has already started to decline on a month-to-month basis. This is not a sign of impending doom - or another collapse in house prices - it is just the normal seasonal pattern.

Even in normal times house prices tend to be stronger in the spring and early summer, than in the fall and winter. Currently there is a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

In the coming months, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. As an example, the September CoreLogic report showed a 0.3% month-to-month decline in September from August, but prices were up 5.0% year-over-year. That was the largest year-over-year increase since 2006.

I think house prices have already bottomed, and that prices will be up close to 5% year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

Note: The Case-Shiller September report will be released this coming Tuesday. For this graph, I used Zillow's forecast for September.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years. The CoreLogic index turned negative in the September report (CoreLogic is 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA will probably turn negative month-to-month in the October report (also a three month average, but not weighted).

Saturday, November 24, 2012

Jim the Realtor: Upcoming REO listings

by Calculated Risk on 11/24/2012 07:48:00 PM

I haven't checked in with Jim the Realtor in San Diego for some time. In this video below, Jim reviews a few upcoming REO listings in North County San Diego. Jim says: "there are only 16 houses owned by banks that aren't on the market" in the North County area (152 homes closed in the area last month, so the bank owned REO will not have much of an impact).

The first house is interesting. It looks like the bank will actually make money when they sell it.

The third house is good for a laugh (starts about 4:20). The bank has made some absurd repairs, like putting in a low end vanity in the master bath to replace a built-in that went all the way across the bathroom. (around 9:20 - Jim can't help but laugh).

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Unofficial Problem Bank list unchanged at 857 Institutions

by Calculated Risk on 11/24/2012 05:27:00 PM

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 23, 2012. (repeat from last week, table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, a very quiet week for the Unofficial Problem Bank List as it went without change. You have to go back to January 6th of this year for the last time it went a week unchanged. The list stands at 857 institutions with assets of $329.2 billion. A year ago, the list held 980 institutions with assets of $400.5 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Next week, the FDIC will likely release its actions through October 2012 and the Official Problem Bank List as of September 30, 2012. The difference between the two lists will likely drop from 187 at last issuance to the low 170s.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th