by Calculated Risk on 1/12/2013 01:10:00 PM

Saturday, January 12, 2013

Schedule for Week of Jan 13th

Earlier:

• Summary for Week Ending Jan 11th

This will be a busy week for economic data. The key reports for this week will be the December retail sales report on Tuesday, and December housing starts on Thursday. On Monday, the focus will be on "a conversation with Fed Chairman Ben Bernanke".

Also the Consumer Price Index (CPI) and Producer Price Index (PPI) for December will be released this week.

For manufacturing, the Fed will release December Industrial Production on Wednesday, and the January NY Fed (Empire state) and Philly Fed surveys will be released this week.

8:45 AM ET: LPS will release their Mortgage Monitor report for November.

4:00 PM: Fed Chairman Ben Bernanke will speak at the University of Michigan's Rackham Auditorium, "Chairman Bernanke visits the University of Michigan for a conversation with Ford School Dean Susan M. Collins on monetary policy, recovery from the global financial crisis, and long-term challenges facing the U.S. economy". The even will be streamed live, and Bernanke will take questions on Twitter: #fordschoolbernanke

8:30 AM: Producer Price Index for December. The consensus is for a 0.1% decrease in producer prices (0.2% increase in core).

8:30 AM ET: Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales.

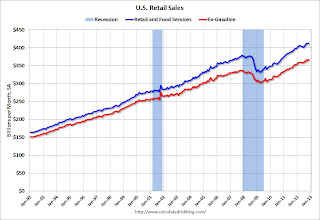

8:30 AM ET: Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through November. Retail sales are up 24.5% from the bottom, and now 8.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.2% in December, and to increase 0.3% ex-autos.

8:30 AM: NY Fed Empire Manufacturing Survey for January. The consensus is for a reading of 0.0, up from minus 8.1 in December (below zero is contraction).

8:30 AM: Corelogic will release their House Price Index for November 2012.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.3% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for December. The consensus is for no change in CPI in December and for core CPI to increase 0.1%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This shows industrial production since 1967 through November.

The consensus is for a 0.2% increase in Industrial Production in December, and for Capacity Utilization to increase to 78.5%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in December. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 368 thousand from 371 thousand last week.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts were at 861 thousand (SAAR) in November, down 3.0% from the revised October rate of 888 thousand (SAAR). Single-family starts decreased to 565 thousand in November.

The consensus is for total housing starts to increase to 887 thousand (SAAR) in December, up from 861 thousand in November.

10:00 AM: Philly Fed Survey for January. The consensus is for a reading of 6.0, down from 8.1 last month (above zero indicates expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 75.0, up from 72.9.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2012