by Calculated Risk on 2/08/2013 08:26:00 AM

Friday, February 08, 2013

Trade Deficit declined in December to $38.5 Billion

The Department of Commerce reported:

[T]otal December exports of $186.4 billion and imports of $224.9 billion resulted in a goods and services deficit of $38.5 billion, down from $48.6 billion in November, revised. December exports were $3.9 billion more than November exports of $182.5 billion. December imports were $6.2 billion less than November imports of $231.1 billion.The trade deficit was much smaller than the consensus forecast of $46.0 billion.

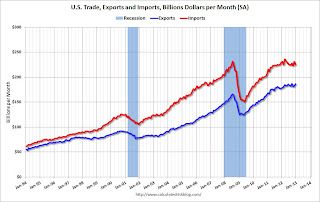

The first graph shows the monthly U.S. exports and imports in dollars through December 2012.

Click on graph for larger image.

Click on graph for larger image.Exports increased in December, and imports decreased.

Exports are 10% above the pre-recession peak and up 4.8% compared to December 2011; imports are near the pre-recession peak, and down 2% compared to December 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The decrease in the trade deficit in December was due to both a decline in petroleum and non-petroleum products.

Oil averaged $95.16 in December, down from $97.45 per barrel in November. But most of the decline in the value of petroleum imports was due to a sharp decline in the volume of imports.

The trade deficit with China increased to $24.5 billion in December, up from $23.1 billion in December 2011. Most of the trade deficit is still due to oil and China.

The trade deficit with the euro area was $7.5 billion in December, down from $8.6 billion in December 2011.

Notes: The trade deficit might have been skewed by the LA port strike that started in late November and ended in early December. This does suggest an upward revision to Q4 GDP.