by Calculated Risk on 3/16/2013 01:14:00 PM

Saturday, March 16, 2013

Schedule for Week of March 17th

Earlier:

• Summary for Week Ending March 15th

There are three key housing reports that will be released this week: February housing starts on Tuesday, February Existing home sales on Thursday, and the March homebuilder confidence survey on Monday.

A key event this week is the two day FOMC meeting on Tuesday and Wednesday. Note: the time has changed for the FOMC announcement and quarterly news conference.

Also, for manufacturing, the Philly Fed survey will be released on Thursday.

10:00 AM ET: The March NAHB homebuilder survey. The consensus is for a reading of 47, up from 46 in February. Although this index has increased sharply in 2012, any number below 50 still indicates that more builders view sales conditions as poor than good.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for January 2013

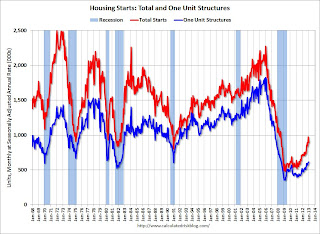

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. Total housing starts were at 890 thousand (SAAR) in January, 8.5% below the revised December estimate of 973 thousand (SAAR). Single-family starts increased to 613 thousand in January.

The consensus is for total housing starts to increase to 919 thousand (SAAR) in February, up from 890 thousand in January.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to interest rates or QE purchases is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 340 thousand from 332 thousand last week. The "sequester" budget cuts might start impacting weekly claims this week.

9:00 AM: The Markit US PMI Manufacturing Index Flash. The consensus is for a decrease to 55.0 from 55.2 in February.

10:00 AM: FHFA House Price Index for January 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 5.01 million on seasonally adjusted annual rate (SAAR) basis. Sales in January were 4.92 million SAAR. Economist Tom Lawler is estimating the NAR will report a sales rate of 4.87 million.

A key will be inventory and months-of-supply.

10:00 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of minus 1.5, up from minus 12.5 last month (below zero indicates contraction).

No releases scheduled.