by Calculated Risk on 3/23/2013 08:11:00 AM

Saturday, March 23, 2013

Summary for Week ending March 22nd

The major story this week was the ongoing crisis in Cyprus. There will be further developments this weekend with a Monday deadline (the ECB will not provide liquidity to Cyprus banks after Monday, without an "EU/IMF programme in place"). The resolution is unclear and anything could happen, although it seems likely that Cyprus will remain in eurozone and receive a bailout - and that large depositors (over €100,000) will take significant losses.

The events in Cyprus are a reminder that there are downside risks to the economy, with the two most obvious risks being Europe and overly restrictive US fiscal policy. Otherwise the economy appears to be improving.

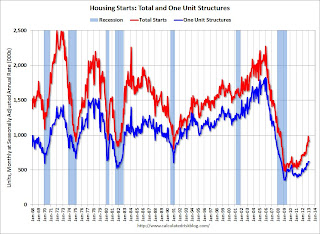

This was another week of solid economic data. Housing starts were up again, and are now up 27.7% year-over-year. Even with the strong increase in starts, total housing starts are still historically very low suggesting more growth over the next few years.

The existing home sales report was solid too with a strong increase in conventional sales. Inventory is still falling sharply on a year-over-year basis, but it appears the year-over-year decline may be slowing (inventory is very low right now).

Other positive data included an increase in the Architecture Billings Index (leading indicator for commercial real estate) that was at the highest level since 2007, and a decrease in the 4-week average of initial weekly unemployment claims - at the lowest level since February 2008. It is a good sign when indicators are the highest in years (or lowest in years for negative indicators like unemployment claims). Even manufacturing showed signs of life in the New York and Philly Fed manufacturing surveys.

The sequestration budget cuts will probably start slowing the economy soon, but right now the economy is clearly improving.

Here is a summary of last week in graphs:

• Housing Starts increased to 917 thousand SAAR in February

Click on graph for larger image.

Click on graph for larger image.

From the Census Bureau: "Privately-owned housing starts in February were at a seasonally adjusted annual rate of 917,000. This is 0.8 percent above the revised January estimate of 910,000 and is 27.7 percent above the February 2012 rate of 718,000.

Single-family housing starts in February were at a rate of 618,000; this is 0.5 percent above the revised January figure of 615,000. The February rate for units in buildings with five units or more was 285,000."

This was at expectations of 919 thousand starts in February. Starts in February were up 27.7% from February 2012; single family starts were up 31.5% year-over-year. Starts in December and January were revised up, and permits were strong. This was another solid report.

• Existing Home Sales in February: 4.98 million SAAR, 4.7 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2013 (4.98 million SAAR) were 0.8% higher than last month, and were 10.2% above the February 2012 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 19.2% year-over-year in February from February 2012. This is the 24th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 19.2% year-over-year in February from February 2012. This is the 24th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply increased to 4.7 months in February.

This was close to expectations of sales of 5.01 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index increases, Strongest Growth since 2007

From AIA: Architecture Billings Index Continues to Improve at a Healthy Pace "The American Institute of Architects (AIA) reported the February ABI score was 54.9, up slightly from a mark of 54.2 in January. This score reflects a strong increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, higher than the reading of 63.2 the previous month – and its highest mark since January 2007."

From AIA: Architecture Billings Index Continues to Improve at a Healthy Pace "The American Institute of Architects (AIA) reported the February ABI score was 54.9, up slightly from a mark of 54.2 in January. This score reflects a strong increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, higher than the reading of 63.2 the previous month – and its highest mark since January 2007."This graph shows the Architecture Billings Index since 1996.

Every building sector is now expanding and new project inquiries are strongly positive (highest since January 2007). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for seven consecutive months and suggests some increase in CRE investment in the second half of 2013.

• Weekly Initial Unemployment Claims increase to 336,000

The DOL reports "In the week ending March 16, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 2,000 from the previous week's revised figure of 334,000. The 4-week moving average was 339,750, a decrease of 7,500 from the previous week's revised average of 347,250."

The DOL reports "In the week ending March 16, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 2,000 from the previous week's revised figure of 334,000. The 4-week moving average was 339,750, a decrease of 7,500 from the previous week's revised average of 347,250."

The previous week was revised up from 332,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 339,750 - this is the lowest level since early February 2008.

Weekly claims were below the 340,000 consensus forecast. Note: Claims might increase over the next few months due to the "sequestration" budget cuts, but right now initial unemployment claims suggest an improving labor market.

• Philly Fed Manufacturing Survey Shows Expansion in March

From the Philly Fed: March Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -12.5 in February to 2.0 this month ... The new orders index increased from a reading of -7.8 in February to 0.5, its first positive reading in three months."

From the Philly Fed: March Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -12.5 in February to 2.0 this month ... The new orders index increased from a reading of -7.8 in February to 0.5, its first positive reading in three months."

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys increased in March, and is back above zero. This suggests the ISM manufacturing index will show further expansion in March.