by Calculated Risk on 4/16/2013 02:50:00 PM

Tuesday, April 16, 2013

A few comments on Housing Starts

A few comments:

• Total housing starts in March were up 46.7% from the March 2012 pace, although some of that increase was due to a surge in multi-family starts in March (Multi-family starts are volatile month-to-month). Single family starts were up 28.7%. That is a very strong year-over-year increase.

• Even with this significant increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase 50% or so from the current level (1.036 million SAAR in March).

• There is some concern that multi-family starts are now too high. That is possible, especially considering all the units currently under construction and not yet completed. However single family starts are still near record lows, and most of the future increase in starts will probably be from single family starts.

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries this year. The level of multi-family starts over the last 12 months - almost to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

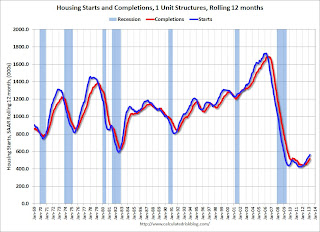

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.