by Calculated Risk on 4/22/2013 08:37:00 AM

Monday, April 22, 2013

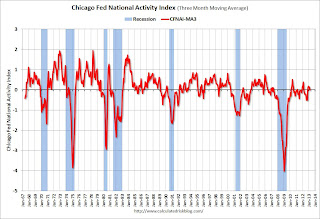

Chicago Fed: "Economic Activity Slower in March"

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in March

Led by declines in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.23 in March from +0.76 in February. Three of the four broad categories of indicators that make up the index decreased from February, and only one of the four categories made a positive contribution to the index in March.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.01 in March from +0.12 in February. March’s CFNAI-MA3 suggests that growth in national economic activity was very near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed in March, and growth was near the historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.