by Calculated Risk on 5/25/2013 11:26:00 AM

Saturday, May 25, 2013

Schedule for Week of May 26th

The key reports this week are the second estimate of Q1 GDP on Thursday, the April Personal Income and Outlays report on Friday, and the Case-Shiller house prices for March on Tuesday.

The FDIC will probably release the Q1 Quarterly Banking Profile this week (no scheduled date).

All US markets will be closed in observance of Memorial Day.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March.

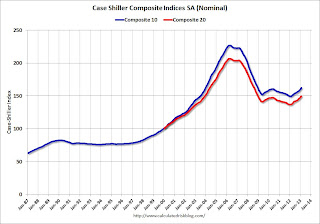

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through February 2012 (the Composite 20 was started in January 2000).

The consensus is for a 10.2% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 9.8% year-over-year, and for prices to increase 0.9% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for May. The consensus is for the index to increase to 71.5 from 68.1.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May. The consensus is for a a reading of minus 3 for this survey, up from minus 6 in April (Below zero is contraction).

10:30 AM: Dallas Fed Manufacturing Survey for May. This is the last of regional surveys for May. The consensus is a reading of minus 8, up from minus 15 in April (below zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims at 340 thousand, unchanged from last week.

8:30 AM: Q1 GDP (second estimate). This is the second estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1, unrevised from the advance report.

10:00 AM ET: Pending Home Sales Index for April. The consensus is for a 1.4% increase in the index.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.1% increase in personal income in April, and for no change in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for an increase to 50.0, up from 49.0 in April.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 83.7.