by Calculated Risk on 6/13/2013 12:28:00 PM

Thursday, June 13, 2013

Freddie Mac: "Mortgage Rates on Six Week Streak Higher"

From Freddie Mac today: Mortgage Rates on Six Week Streak Higher

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates climbing higher amid a solid employment report for May. Since beginning their climb last month, the 30-year fixed-rate mortgage has increased over half a percentage point. ...This graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

30-year fixed-rate mortgage (FRM) averaged 3.98 percent with an average 0.7 point for the week ending June 13, 2013, up from last week when it averaged 3.91 percent. Last year at this time, the 30-year FRM averaged 3.71 percent.

15-year FRM this week averaged 3.10 percent with an average 0.7 point, up from last week when it averaged 3.03 percent. A year ago at this time, the 15-year FRM averaged 2.98 percent.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.18% and 30 year mortgage rates are at 3.98% (according to Freddie Mac). Based on the relationship from the graph, if the ten year yield stays in this range, 30 year mortgage rates might move up to 4.1% or so in the Freddie Mac survey.

Note: The yellow markers are for the last three years with the ten year yield below 3%. A trend line through the yellow markers only is a little lower, but still close to 4% at the current 10 year Treasury yield.

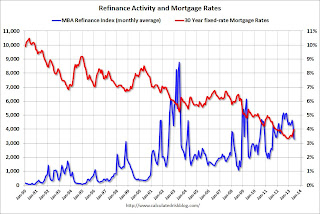

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 36% over the last 5 weeks) and will probably decline significantly if rates stay at this level.