by Calculated Risk on 7/31/2013 11:36:00 AM

Wednesday, July 31, 2013

Q2 GDP: More Weakness, Data below FOMC June Projections

Overall this was another weak GDP report although slightly above expectations.

It appears that the drag from state and local governments might be ending, although the drag from Federal government spending is ongoing.

Residential investment (RI) remains a bright spot (increasing at a 13.4% annualized rate), and RI as a percent of GDP is still very low - and I expect RI to continue to increase over the next few years.

For the FOMC meeting today, the data showed all indicators are still below the June projections (see bottom three graphs).

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 11 quarters (through Q2 2013).

And the drag from state and local governments may be ending.

At the least the drag has diminished, and based on recent news reports, I expect state and local governments to make small positive contributions to GDP going forward.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

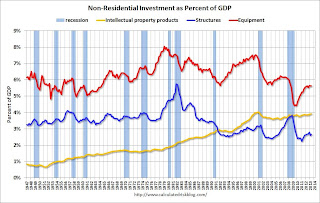

The third graph shows non-residential investment in structures, equipment and the new category "intellectual property products".

The third graph shows non-residential investment in structures, equipment and the new category "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014 (with the usual caveats about Europe and policy errors in the US).

The following charts are relevant for the FOMC meeting today. At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

This graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first and second quarters were below the FOMC projections (red), and GDP will have to pickup in the 2nd half of 2013 for the Fed to start tapering QE3 purchases in December.

GDP would have to increase at a 3.2% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.8% rate to reach the higher projection.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

So far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

PCE prices would have to increase at a 1.8% annual rate in the 2nd half to reach the upper FOMC projection.

This graph is for core PCE prices.

This graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

So far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.