by Calculated Risk on 7/05/2013 01:58:00 PM

Friday, July 05, 2013

Update: Four Charts to Track Timing for QE3 Tapering

We now have data to update all four charts that I'm using to track when the Fed will start tapering the QE3 purchases.

At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

Click on graph for larger image.

Click on graph for larger image.The first graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first quarter was below the FOMC projections (red), and it appears the second quarter will also be below the FOMC forecast - if so, then GDP will have to pickup in the 2nd half of 2013 for the Fed to start tapering QE3 purchases in December.

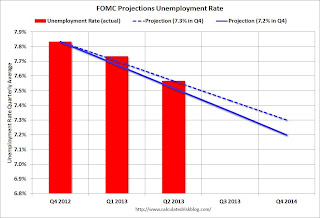

The second graph is for the unemployment rate.

The second graph is for the unemployment rate.The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We now have data through Q2, and so far the unemployment rate is tracking at the high end of the forecast.

If the participation rate ends the year at 63.6% (level for the year), then job growth will have to pickup up a little in the 2nd half to meet the FOMC projections. See the Atlanta Fed's Jobs Calculator tool to estimate how many jobs per month will be needed to reach a certain unemployment level.

The third graph is for PCE prices.

The third graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through May, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The fourth graph is for core PCE prices.

The fourth graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through May, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It has only been just over two weeks since the FOMC press conference, and all of the data has been worse than the FOMC forecasts (GDP revised down, unemployment rate at high end, prices below forecast). It would be a stretch to say the incoming data has been "broadly inconsistent" with the June FOMC projections, but clearly the economy will have to pickup before the FOMC would meet their "broadly consistent" goal and start to taper QE3 purchases in December. (September tapering seems less likely now since the key data has been worse than forecast, but still not impossible).