by Calculated Risk on 8/23/2013 02:50:00 PM

Friday, August 23, 2013

5% 30 Year Mortgage Rates?

It seems like yesterday that I wrote 4% 30 Year Mortgage Rates? (it was a few months ago in May).

Now there is some discussion of 5% 30 year mortgage rates. Here is what mortgage banker Lou Barnes wrote today:

Release of the Fed’s July 31 meeting minutes on Wednesday collapsed the last courage in the bond market, 10-year T-notes to 2.90% and low-down, low-fee mortgages to 5.00%. The minutes were incomprehensible, but their failure to pull back from taper of QE3 means that it is still a “go.”Barnes is talking about "low-down, low-fee" 30 year mortgages hitting 5%, but his comment made me wonder at what 10 year Treasury yield, mortgage rates in the Freddie Mac survey would probably rise to 5%?

This morning Treasury short-sellers so pleased with themselves got clobbered by word that new home sales had fainted 13.4% in July, and June was revised down by 8%. The 10-year briefly to 2.81%. New home sales are measured by new contracts written, thus these June-July results are the first since mortgage rates jumped 1% from May to June. Correlation is not cause ... some of the weakness is due to a shortage of inventory in turn caused by a shortage of credit to developers and builders.

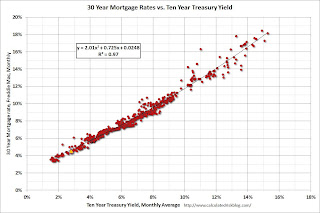

Here is an update to a graph that shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.82% and 30 year mortgage rates are at 4.58% (according to Freddie Mac). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 5% when 10-year Treasury yields are around 3.33%.

Note: The yellow marker is the current (last week) relationship.

1 Long term readers will remember the quote about "neutron loans" from mortgage banker Lou Barnes in 2007:

“All of the old-timers knew that subprime mortgages were what we called neutron loans — they killed the people and left the houses,” said Louis S. Barnes, 58, a partner at Boulder West, a mortgage banking firm in Lafayette, Colo.