by Calculated Risk on 8/23/2013 11:20:00 AM

Friday, August 23, 2013

Comments on New Home Sales

Three key comments:

1. This is just one month of data (I note this whenever we see a weak or strong sales report). There is plenty of month-to-month noise for new home sales and frequent large revisions.

2. The downward revisions to previous months were expected (In the weekly schedule I wrote: "Based on the homebuilder reports, there will probably be some downward revisions to sales for previous months."). But these revisions do suggest the housing recovery was not as strong as previously thought.

3. Important: Any impact from rising mortgage rates would show up in the New Home sales report before the existing home sales report. New home sales are counted when contracts are signed, and existing home sales when the transactions are closed - so the timing is different. For existing home sales, I think there was a push to close before the mortgage interest rate lock expired - so closed existing home sales in July were strong - and I expect a decline in existing home sales in August.

For New Home sales, I expect some buyers were shocked by the increase in rates - and they held off signing a contract in July. But this doesn't mean the housing recovery is over - far from it. In fact I think the housing recovery (starts / new home sales) has just begun.

Earlier: New Home Sales decline sharply to 394,000 Annual Rate in July

Looking at the first seven months of 2013, there has been a significant increase in sales this year. The Census Bureau reported that there were 271 new homes sold in the first half of 2013, up 21.5% from the 223 thousand sold during the same period in 2012. This was the highest sales for the first seven months of the year since 2008.

And even though there has been a large increase in the sales rate, sales are just above the lows for previous recessions. This suggests significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current sales rate.

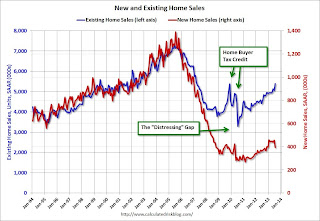

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through June 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to continue to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.