by Calculated Risk on 8/08/2013 02:24:00 PM

Thursday, August 08, 2013

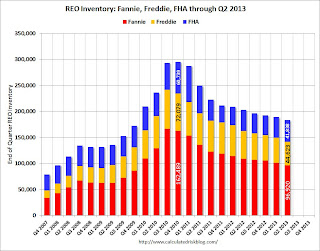

Fannie, Freddie, FHA REO inventory declines in Q2 2013

Fannie released their second quarter results this morning. In their SEC filing, Fannie reported their Real Estate Owned (REO) declined to 96,920 single family properties, down from 101,449 at the end of Q1.

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA declined to 183,381 at the end of Q2 2013, down 3% from Q1, and down almost 10% from 202,765 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too.

Although REO was down for Fannie and Freddie in Q2 from Q1, REO increased for the FHA for the 2nd consecutive quarter - this is something to watch.