by Calculated Risk on 8/10/2013 01:05:00 PM

Saturday, August 10, 2013

Schedule for Week of August 11th

This will be a busy week for economic data. A key report will be July retail sales to be released on Tuesday. Also there are two key housing reports that will be released later in the week; housing starts on Friday, and the homebuilder confidence survey on Thursday.

For manufacturing, the July Industrial Production survey, and the August NY Fed (Empire State) and Philly Fed surveys will be released this week.

For prices, PPI will be released on Wednesday, and CPI on Thursday.

2:00 PM ET: Monthly Treasury Statement for July. The CBO has projected a deficit of $96 billion in July 2013, down $10 billion from July 2012 after accounting for "quirks of the calendar".

7:30 AM ET: NFIB Small Business Optimism Index for July.

8:30 AM ET: Retail sales for July will be released.

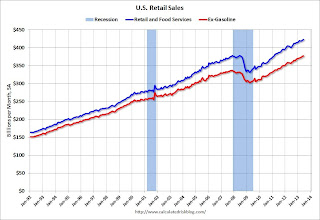

8:30 AM ET: Retail sales for July will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 27.5% from the bottom, and now 11.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.4% in July, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.3% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Producer Price Index for July. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

11:00 AM: The Q2 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 340 thousand from 333 thousand last week.

8:30 AM: Consumer Price Index for July. The consensus is for a 0.2% increase in CPI in July and for core CPI to increase 0.2%.

8:30 AM: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 10.0, up from 9.5 in July (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

10:00 AM ET: The August NAHB homebuilder survey. The consensus is for a reading of 57, the same as in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 15.8, down from 19.8 last month (above zero indicates expansion).

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts were at 836 thousand (SAAR) in June. Single family starts were at 591 thousand SAAR in June.

The consensus is for total housing starts to increase to 904 thousand (SAAR) in July.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 85.5, up from 85.1 in July.