by Calculated Risk on 9/06/2013 10:30:00 AM

Friday, September 06, 2013

Employment Report Comments (more graphs)

Overall this was a weak employment report. Although the headline number of 169,000 jobs added was just a little below the consensus forecast, the downward revisions to the June and July estimates were significant (74,000 fewer jobs than previously reported). Disappointing.

The decline in the unemployment rate to 7.3% in August, from 7.4% in July, was due to a decline in the participation rate (not good news). If the participation rate had held steady, the unemployment rate would have increased to 7.5% instead of declining to 7.3%.

However if we look at the year-over-year change in employment - to minimize the monthly volatility - total nonfarm employment is up 2.206 million from August 2012, and private employment is up 2.300 million. That is essentially the same year-over-year gain as in July (2.202 million total, 2.279 million private year-over-year in July).

So the story mostly remains the same: slow and steady job growth.

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The ratio was unchanged at 75.9% in August. This ratio should probably move close to 80% as the economy recovers, but that also requires an increase in the 25 to 54 participation rate.

The participation rate for this group declined to 81.0% in August. The decline in the participation rate for this age group is probably mostly due to economic weakness (as opposed to demographics) and this suggests the labor market is still very weak.

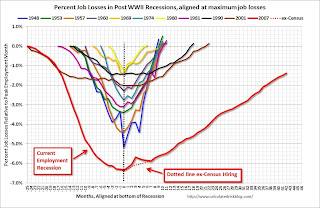

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 334,000 to 7.9 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers declined in August to 7.911 million.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 13.7% in August from 14.0% in July. This is the lowest level for U-6 since December 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.290 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 4.246 million in July. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In August 2013, state and local governments added 17,000 jobs, and state and local employment is up 17 thousand so far in 2013 (basically flat).

I think most of the state and local government layoffs are over. Of course Federal government layoffs are ongoing - and with many more layoffs expected.

Overall this was a weak report - especially with the downward revisions to June and July employment and the sharp decline in the participation rate (the reason the unemployment rate declined). The labor market is still weak and millions of people are unemployed or underemployed.