by Calculated Risk on 11/05/2013 08:59:00 AM

Tuesday, November 05, 2013

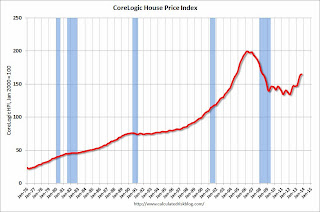

CoreLogic: House Prices up 12.0% Year-over-year in September

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 12 Percent Year Over Year in September

Home prices nationwide, including distressed sales, increased 12 percent on a year-over-year basis in September 2013 compared to September 2012. This change represents the 19th consecutive monthly year-over-year increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.2 percent in September 2013 compared to August 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 10.8 percent in September 2013 compared to September 2012. On a month-over-month basis, excluding distressed sales, home prices increased 0.3 percent in September 2013 compared to August 2013. Distressed sales include short sales and real estate owned (REO) transactions.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.2% in September, and is up 12.0% over the last year. This index is not seasonally adjusted, and the month-to-month changes will be smaller for next several months.

The index is off 17.5% from the peak - and is up 22.8% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for nineteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for nineteen consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

I expect the year-over-year price increases to slow in the coming months.