by Calculated Risk on 11/04/2013 08:15:00 AM

Monday, November 04, 2013

LPS on Mortgages: New Problem Loan Rates Close to Pre-crisis Levels

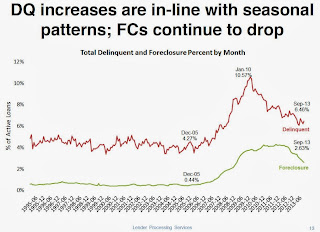

LPS released their Mortgage Monitor report for September today. According to LPS, 6.46% of mortgages were delinquent in September, up from 6.20% in August. LPS reports that 2.63% of mortgages were in the foreclosure process, down from 3.86% in September 2012.

This gives a total of 9.03% delinquent or in foreclosure. It breaks down as:

• 1,935,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,331,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,328,000 loans in foreclosure process.

For a total of 4,593,000 loans delinquent or in foreclosure in September. This is down from 5,640,000 in September 2012.

This graph from LPS shows percent of loans delinquent and in the foreclosure process over time.

From LPS:

• Delinquencies increased, but in-line with seasonal patternDelinquencies and foreclosures are still high, but moving down - and might be back to normal levels in a couple of years.

• Foreclosure inventories continue to improve with first time foreclosure starts at multi-year lows

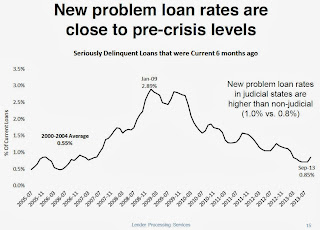

The second graph from LPS shows new problem loans. There are seriously delinquent loans that were current 6 months ago. This is good news going forward (although the lenders are still working through the backlog, especially in judicial foreclosure states).

There is much more in the mortgage monitor.