by Calculated Risk on 2/07/2014 10:02:00 AM

Friday, February 07, 2014

Comments on Employment Report: Disappointing Payroll Number

This was another disappointing employment report, but there were several positive - as an example there were upward revisions to prior months, the unemployment rate declined while the participation rate increased (a good sign), the number of long term unemployed declined, and the number of people working part time for economic reasons declined sharply.

Private payroll employment increased 142 thousand and is now 291 thousand below the previous peak (total employment is still 866 thousand below the peak in January 2008). It is likely that private employment will be at a new high in March.

Of course government employment was down again, and even state and local employment is barely above the post-recession minimum (last graph).

This is the second consecutive month with a disappointing headline payroll number, but my outlook hasn't changed (I still expect payroll employment to pickup this year). Of course if the employment data continues at this level, I'll change my mind.

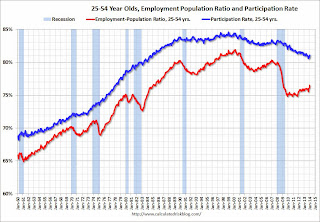

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in January to 81.1% from 80.7%, and the 25 to 54 employment population ratio increased to 76.5% from 76.1%. This was a large increase in participation, and as the recovery continues, I expect the participation rate for this group to increase.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 514,000 to 7.3 million in January. These individuals were working part time because their hours had been cut back or because they were unable to find full-time work.These workers are included in the alternate measure of labor underutilization (U-6) that declined to 12.7% in January. This is the lowest level since November 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.646 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 3.878 in December. This is the lowest level since March 2009 (this might have been impacted by the expiration of extended unemployment benefits). This is trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In January 2014, state and local governments lost 17,000 jobs.

It appears state and local employment employment has bottomed. Of course Federal government layoffs are ongoing.