by Calculated Risk on 4/29/2014 10:17:00 AM

Tuesday, April 29, 2014

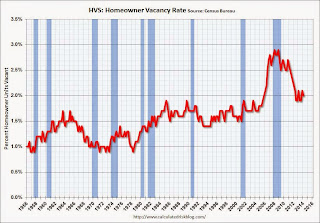

HVS: Q1 2014 Homeownership and Vacancy Rates

The Census Bureau released the Housing Vacancies and Homeownership report for Q1 2014 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate,except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.8% in Q1, from 65.2% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

The HVS homeowner vacancy decreased to 2.0% in Q1.

The HVS homeowner vacancy decreased to 2.0% in Q1.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

The rental vacancy rate increased slightly in Q1 to 8.3% from 8.2% in Q4.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that most of the bubble excess is behind us.