by Calculated Risk on 5/21/2014 09:36:00 AM

Wednesday, May 21, 2014

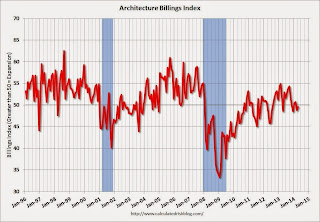

AIA: "Contraction in Architecture Billings Index Continues"

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Contraction in Architecture Billings Index Continues

The Architecture Billings Index (ABI) has reverted into negative territory for the last two months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the [April] ABI score was 49.6, up slightly from a mark of 48.8 in March. This score reflects a decrease in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.1, up from the reading of 57.9 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in April was 54.6.

“Despite an easing in demand for architecture services over the last couple of months, there is a pervading sense of optimism that business conditions are poised to improve as the year moves on,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “With a healthy figure for design contracts this should translate into improved billings in the near future.”

•Regional averages: South (57.5),West (48.9), Midwest 47.0), Northeast (42.9) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.6 in April, up from 48.8 in March. Anything below 50 indicates contraction in demand for architects' services. This index has indicated expansion during 16 of the last 21 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The index has been moving sideways near the expansion / contraction line recently. However, the readings over the last year and a half suggest some increase in CRE investment in 2014.